Table of Contents

DK Basu Judgment

Context: The Supreme Court recently labelled an event on the 2022 in Kheda district, Gujarat (where four police officers were seen publicly whipping Muslim men, who were bound to a pole) as an “atrocity.”

More In News

- The conduct of the four officers were found to be in contempt of the directions of the SC in the D.K. Basu judgement of 1996 against police abuse and custodial violence.

Directions Given in DK Basu Judgement

- The D.K. Basu verdict had highlighted the deep concern in a free society for the protection of an individual from torture and abuse by the police and other law-enforcing officers.

- Police under a legal duty and has legitimate right to arrest a criminal and to interrogate him during the investigation of an offence but the law does not permit use of third degree methods or torture of accused in custody during interrogation and investigation.

Cauvery Water Regulation Committee

Context: Recently, All India Secretaries Conference on Water Vision @2047-Way Ahead was organised by the National Water Mission of the Ministry of Jal Shakti, and coordinated by the Tamil Nadu Water Resources Department.

About Cauvery Water Regulation Committee

- Establishment: Utilising the authority granted by Section 6A of the Inter-State River Water Disputes Act of 1956, the Central Government announced the establishment of the Cauvery Water Management Scheme on the 1st of June, 2018.

- This scheme notably includes the creation of the ‘Cauvery Water Management Authority’ and the ‘Cauvery Water Regulation Committee.’

- These bodies were set up to enforce the directives of the Cauvery Water Disputes Tribunal, which were revised by the Supreme Court in its order dated February 16, 2018.

- Functions:

- To gather daily updates on water levels, inflows, and storage data from the Hemavathy, Harangi, Krishnarajasagara, Kabini, Mettur, Bhavanisagar, Amaravathy, and Banasura Sagar reservoirs.

- To oversee the scheduled release of water ten times a month from these reservoirs as instructed by the Cauvery Water Management Authority.

- To record the volume of water discharged from the mentioned reservoirs on a bi-hourly basis.

- To have the Authority’s appointed representatives at each reservoir ensure the accurate execution of the release instructions from the Committee and to report any discrepancies immediately to the Member Secretary of the Committee for further action.

- To track the daily flow of water at the inter-state checkpoint, Biligundlu gauge and discharge site, and to keep the Authority updated.

- To compile and balance the monthly water usage accounts for each reservoir.

- To collect and summarise weekly meteorological data from key rain gauge stations managed by the India Meteorological Department, in order to estimate the state of the monsoon and update the Authority on monsoon conditions.

- To have state representatives responsible for major water projects report regularly on rainfall in their areas and advise if adjustments to water discharges are necessary.

- To create seasonal and annual reports on water usage and submit them to the Authority within the specified periods:

- For the South-West monsoon season, which includes the first half of October: from June 1st to October 15th.

- For the North-East monsoon season: from October 16th to January 31st.

- For the Hot weather season: from February 1st to May 31st.

The need to overhaul a semiconductor scheme

Context: India’s Semiconductor Design-Linked Incentive scheme requires revisions to strengthen local chip design, enhance global industry integration, and improve investment appeal.

About Design-Linked Incentive (DLI) Scheme

- Objective: Develop a robust ecosystem for semiconductor chip design within India.

- Goal: Cultivate at least 20 native firms specialising in semiconductor design, aiming for over ₹1500 Crore turnover within five years.

- Nodal Organisation: The Centre for Development of Advanced Computing (C-DAC).

- Criteria: The scheme provides monetary benefits and assistance with design infrastructure through different phases of creation and implementation for semiconductor designs related to Integrated Circuits (ICs), Chipsets, Systems on Chips (SoCs), Systems, IP Cores, and associated design activities for a period of 5 years.

- Scheme Structure: The initiative comprises three key elements:

- Design Infrastructure Provision: C-DAC to establish the India Chip Centre, providing cutting-edge design tools, IP Cores, and support for fabrication and validation processes to eligible firms.

- Incentives for Product Design: Approved entities may receive a reimbursement covering up to 50% of qualifying costs, up to ₹15 Crore per application, for semiconductor design efforts.

- Sales-Based Incentives: Incentives ranging from 6% to 4% of the net sales revenue over five years, with a maximum of ₹30 Crore per application, will be offered to entities whose designs are incorporated into electronic products.

- Incentive Retention Clause: Beneficiaries of the scheme must maintain a majority Indian ownership (over 50% capital held by Indian residents or Indian-owned companies) for at least three years post-incentive claim.

Current Status

The Semiconductor Design Linked Incentive (DLI) scheme in India is due for a mid-term appraisal. Despite some achievements, it’s marked that only seven startups, reporting over its target of harnessing 100 over five years, made significant improvements. This points to an opportunity for policymakers to revise and revamp the scheme.

Situation Analysis

India’s $10 billion Semicon India Program has seen mixed results, which indicates a need for a strategic revision in three areas:

- Reducing reliance on semiconductor imports, especially from China, to boost national security and self-reliance in strategic sectors.

- Integrating into the global semiconductor value chain to build supply chain resilience.

- Capitalising on India’s existing strengths, such as the presence of design houses and skilled Indian chip design engineers.

Challenges associated with the DLI Scheme

- FDI Restrictions: Start-ups must retain their local ownership status for three years post-incentive to qualify, restricting FDI to less than 50% of funding.

- Domestic Capital Shortages: Significant capital requirements for semiconductor start-ups, combined with India’s nascent start-up investment landscape, create funding hurdles.

- Inadequate Incentives: The financial incentives provided by the DLI scheme, with a maximum cap of ₹15 Crore for Product DLI, are too low to effectively entice start-ups.

- Nodal Agency Challenges: Potential conflicts of interest arise with C-DAC acting as both the nodal agency and a competitor within the Indian semiconductor design market.

Way Forward

- Broadening Scheme Focus: The scheme’s priority should be to enhance design capabilities for entities based in India, regardless of their global registration status.

- Emphasising Design Development: Prioritising investment in the design phase of the semiconductor supply chain should be less financially demanding than funding foundry and assembly operations, necessitating an increase in the scheme’s financial provisions.

- Revamping Nodal Agency Structure: Using the model of Karnataka’s Semiconductor Fabless Accelerator Lab, known for its strategic industry partnerships, could serve as a template for the management and execution of the DLI scheme.

Analysing the rising gap in incomes

Context: While the SBI report suggests income inequality has fallen, a closer look reveals persistent disparities in specific areas, indicating a more intricate picture.

About SBI Report On Inequality

- According to a new study by the SBI which analysed data from taxpayers, there’s been a decline in India’s income inequality.

- The Gini coefficient, which measures inequality on a scale from 0 (complete equality) to 1 (complete inequality), has reportedly dropped from 0.472 to 0.402 between the fiscal years 2014-15 and 2022-23.

- Despite this decrease, the study also notes an increasing polarisation of incomes.

Insights from PLFS (data from 2017-18 and 2022-23) on Income Disparity

- Income Below Tax Bracket: PLFS data from 2022-23 indicates that around 80% of income-earners receive an annual income below the ₹2.5 lakh tax threshold.

- Income Polarisation: The disparity in income growth rates between the wealthiest 10% and the poorest 30% points to income polarisation, especially among the self-employed.

- Impact of Gendered Employment: The prevalence of low-paying, part-time jobs among women in the self-employment sector is seen as a contributing factor to this polarisation.

- Gini Coefficient Variations: The Gini coefficient for self-employed individuals has slightly increased by 1.5%, whereas it has decreased for both regular and casual wage workers by 1.7% and 4.8% respectively.

- Inequality Trend Disparities: Overall, inequality has reduced, but the data suggests a more substantial decrease among higher income earners compared to the broader population.

- Increasing 90/10 Income Ratio: The income ratio between the top 10% and bottom 10% earners has risen from 6.7 to 6.9, highlighting a growing income gap.

VAIBHAV Scheme

Context: The Department of Science and Technology (DST) has declared the inaugural group of Fellows under the Vaibhav scheme, designed to bring Indian-origin scientists from overseas for brief collaborative projects.

More In News

- These fellows will dedicate one to two months annually, for a period of up to three years, to work at various Indian institutions such as the Indian Institute of Science, IITs, and the Tata Institute of Fundamental Research.

- The host institutes will be provided with a research grant to facilitate the stay of these fellows, who are anticipated to launch a project or a technology start-up within a three-year timeframe.

- Two distinguished fellowships were offered to the senior professors Arogyaswami Paulraj (Stanford University) and Jitendra Malik (University of California, Berkeley).

About Vaishvik Bhartiya Vaigyanik (Vaibhav) Scheme

- Objective: The VAIBHAV initiative aims to establish connections between the Indian diaspora in the fields of Science, Technology, Engineering, Mathematics, and Medicine (STEMM) and Indian academic and R&D institutions for joint research ventures.

- Overseeing Ministry: The program is managed by the Department of Science and Technology (DST) under the Ministry of Science and Technology.

- Eligibility Criteria for Applicants:

- Must be a Non-Resident Indian (NRI), Person of Indian Origin (PIO), or Overseas Citizen of India (OCI) residing abroad.

- Should hold a Ph.D, M.D, or M.S degree from an accredited university.

- Needs to be actively involved in research in an academic, research, or industrial institution abroad, preferably one within the top 500 in the QS World University Ranking.

- Eligibility Criteria for Host Institutions: Indian higher educational institutions or universities ranked within the top 200 in the NIRF overall rankings and possessing a NAAC ‘A’ grade (score of 3.0 or higher) or scientific institutes.

- Funding Provisions: Fellows will receive a monthly fellowship grant of INR 4,00,000, along with coverage for international and domestic travel, accommodation, and other contingencies.

- Program Features:

- 75 VAIBHAV fellowships will be awarded to exceptional scientists and technologists of Indian origin (NRI/OCI/PIO) working abroad.

- Fellows are invited to collaborate in 18 specific knowledge areas such as quantum technology, health, pharma, electronics, agriculture, energy, computer sciences, and material sciences.

- VAIBHAV fellows can choose an Indian institution for collaboration and are allowed to spend up to two months annually, for a maximum duration of three years.

Direct Tax to GDP Ratio

- Direct Tax Collections:

- In the financial year (FY) 2022-23, the total direct tax collection is ₹16,63,668 crore.

- There has been a year-over-year (YOY) growth of 17.8% in total direct tax collections from the previous financial year.

- Corporate Tax and Personal Income Tax contributions for FY 2022-23 are ₹8,25,834 crore and ₹8,33,307 crore, respectively.

- The direct tax-GDP ratio for FY 2022-23 is 6.11%.

- Maharashtra, Delhi, Karnataka, and Tamil Nadu (collectively accounted for 68.6%) are the top contributors to the direct tax collections.

- Tax Buoyancy: The buoyancy factor for FY 2022-23 is 1.18, which is a decline from 2.52 in FY 2021-22.

- Number of Return Filers:

- The total number of return filers in FY 2022-23 is 7,40,10,269.

- The number of individual filers for FY 2022-23 is 6,96,90,925.

- The number of firm filers is 15,10,551; the number for Hindu Undivided Families (HUF) is 12,46,413, and the number of companies is 10,27,200 for FY 2022-23.

- Direct Tax-GDP Ratio: The direct tax-GDP ratio has hit a 15-year high in FY 2022-23, with a 6.3% increase from FY 2022.

- Additional Notes:

- The tax buoyancy indicates the efficiency of tax collection in relation to the economy’s growth.

- A tax buoyancy greater than1 reflects a faster growth in taxes as the against country’s national income.

- Tax buoyancy was higher in the previous year due to a low base effect.

- The direct tax-GDP ratio shows the share of taxes in the country’s output.

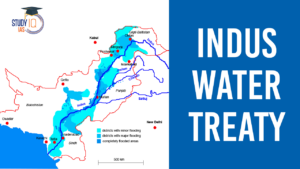

Indus Water Treaty 1960 Suspended by Ind...

Indus Water Treaty 1960 Suspended by Ind...

5 Years of SVAMITVA Scheme and Its Benef...

5 Years of SVAMITVA Scheme and Its Benef...

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...