Table of Contents

India’s Flora and Fauna

Context

Data released by Union Environment Minister Bhupendra Yadav showed the new species of plant and animal species discovered in India in 2023.

About the Discovery

- In 2023, total species added:

- 641 species were added to Indian fauna:

- 442 entirely new to science.

- 199 newly recorded in the country.

- 339 taxa were added to the plant database:

- 171 taxa new to science.

- 168 new to distributional records from India.

- Top States for New Species Discoveries:

- Kerala: Topped the list with 101 additions (74 completely new species, 27 new records).

- West Bengal: 72 new species.

- Tamil Nadu: 64 new species.

- Top States for New Plant Discoveries: West Bengal has the highest number with 52 new taxa followed by Kerala and Uttarakhand.

- Fauna Discoveries Breakdown:

- Invertebrates: 564 new species discovered in 2023.

- Vertebrates: 77 new species, with the majority being fish species.

- Notable Discoveries:

- Curcuma kakchingense, a new species of turmeric found in Kakching, Manipur

- Asystasia venui, a flowering plant discovered in the Acharya Jagdish Chandra Bose Indian Botanic Garden, Howrah, West Bengal.

- Capra himalayensis: Confirms that the Himalayan Ibex in Jammu and Kashmir, Ladakh, and Himachal Pradesh is distinct from the Siberian Ibex.

- Miniopterus srinii: A new species of bent-winged bat found in Kodagu district, Karnataka.

- 641 species were added to Indian fauna:

Education in 7th Schedule

Context

The government cancelled the UGC-NET exam post-conduct and postponed the CSIR-NET and NEET-PG exams.

Historical Background

- British Rule: The Government of India Act, of 1935 created a federal structure, placing education under the provincial list.

- Post-Independence: Education remained a State list subject under the distribution of powers.

- Emergency Era: The Congress party’s Swaran Singh Committee recommended moving education to the concurrent list, implemented through the 42nd constitutional amendment (1976).

- Janata Party’s Attempt: The 44th constitutional amendment (1978) by the Janata Party government sought to revert education to the State list, but was only passed in the Lok Sabha.

International Practices

- United States: State and local governments set educational standards, mandate tests, and supervise institutions. The federal department focuses on financial aid policies and equal access.

- Canada: Education is managed entirely by provinces.

- Germany: Legislative powers for education are vested with landers (States).

- South Africa: Education is governed by two national departments, with provincial departments implementing policies and handling local issues.

Arguments for and Against Centralization of Education

In Favour of Concurrent List

- Uniform Education Policy: Ensures consistent educational standards across the country.

- Improvement in Standards: Central oversight could potentially enhance educational quality.

- Synergy Between Centre and States: Facilitates collaboration and unified policy implementation.

Against Concurrent List

- Diversity and Local Needs: A uniform policy may not suit the diverse needs of different regions.

- Financial Responsibility: States bear the majority of education expenditure.

- Expenditure Data: Out of ₹6.25 lakh crore spent by education departments (2020-21), 85% is by States and 15% by the Centre. Including other departments, the split is 76% by States and 24% by the Centre.

- Centralization Issues: Recent NEET and NTA issues indicate that centralization does not eliminate problems like corruption and lack of professionalism.

Proposed Way Forward

- Move Education Back to State List:

- Tailor-Made Policies: States can develop customised policies for syllabus, testing, and admissions, especially for professional courses like medicine and engineering.

- Central Regulatory Mechanisms: Institutions like the National Medical Commission, University Grants Commission, and All India Council for Technical Education should continue to regulate higher education standards.

Foreign Portfolio Investments (FPIs)

Context

Foreign Portfolio Investors (FPIs) invested ₹26,565 crore in Indian equities in June.

More In News

Prior to June, there were two months of net outflow:

- ₹25,586 crore outflow in May due to poll jitters.

- Over ₹8,700 crore outflow in April due to concerns over India’s tax treaty with Mauritius and rising US bond yields.

What are Foreign Portfolio Investors?

- Foreign portfolio investment (FPI): It involves holding securities and other financial assets by foreign investors without direct control over the assets. It is generally more liquid and influenced by market volatility.

- Types of FPIs: Includes various forms like stocks, bonds, mutual funds, exchange-traded funds, American Depositary Receipts (ADRs), and Global Depositary Receipts (GDRs).

- Economic Impact: FPI is a component of a country’s capital account and appears on its Balance of Payments (BOP), which tracks monetary exchanges between countries over a fiscal year.

- Regulation: In India, the Securities and Exchange Board of India (SEBI) updated its FPI Regulations in 2019, replacing the older 2014 regulations.

- Characteristics: Often referred as “hot money,” FPI is known for its liquidity and volatility, making it riskier and prone to rapid withdrawal from markets at the first hint of economic distress.

Benefits of Foreign Portfolio Investments

- Access to International Credit: FPI enables investors to tap into additional credit opportunities abroad, allowing for increased leverage and potentially higher returns on equity.

- Enhancing Liquidity of Domestic Capital Markets: The infusion of FPI increases market liquidity, making the markets deeper and wider, which facilitates financing for a broader range of investments and assures investors of the ability to manage their portfolios or liquidate positions as needed.

- Promotion of Equity Market Development: FPI fosters competition for financial resources, enhancing corporate performance, prospects, and governance. Increased market liquidity and functionality lead to more value-relevant equity prices, driving overall market efficiency.

Disadvantages

- Volatility and Short-Termism: FPIs are highly liquid and can be quickly moved in and out of markets, which often leads to increased volatility.

- Investors may pull out their investments at the first sign of trouble or better opportunities elsewhere, leading to sudden financial outflows that can destabilise markets.

- Market Manipulation Risks: Large flows of FPIs can lead to significant price movements in the domestic markets, which might not necessarily reflect the underlying economic fundamentals. This can result in asset bubbles or exacerbate market crashes.

- Limited Contribution to Real Economy: Unlike Foreign Direct Investment (FDI), FPI does not contribute directly to the real economy in terms of job creation, infrastructure development, or technological advancements since it mostly goes into purchasing existing securities.

- Currency Risks: Large inflows and outflows of FPI can lead to significant currency fluctuations.

- While inflows can lead to currency appreciation, making exports less competitive, outflows can result in depreciation, leading to inflationary pressures.

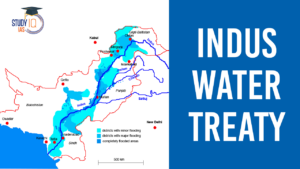

Indus Water Treaty 1960 Suspended by Ind...

Indus Water Treaty 1960 Suspended by Ind...

5 Years of SVAMITVA Scheme and Its Benef...

5 Years of SVAMITVA Scheme and Its Benef...

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...