Table of Contents

Context: The International Monetary Fund (IMF) has laid out a nine-point action plan for how countries should treat crypto assets.

What are Crypto Assets?

- Digital Assets: Crypto assets are purely digital assets that use public ledgers over the internet to prove ownership.

- Technology: They use cryptography, peer-to-peer networks and a distributed ledger technology (DLT) – such as blockchain – to create, verify and secure transactions.

- Cryptography is the method that secures data from unauthorized access by the use of encryption techniques.

- A distributed ledger is a type of database that stores electronic records shared and replicated across many locations and maintained by members of this decentralized network.

- Blockchain is one type of distributed ledger that arranges the data in chunks and chains them together.

- Blockchains can be used to store many types of data but have recently become popular for their use of storing cryptocurrency transaction history.

- Control: Crypto assets generally operate independently of a central bank, central authority or government.

Types of Crypto Assets

- Cryptocurrency: A cryptocurrency is a medium of exchange, such as the rupee or the US dollar, but is digital in format and uses encryption techniques to both control the creation of monetary units and to verify the exchange of money.

- It is decentralized digital money that is based on blockchain technology and secured by cryptography.

- Utility Tokens: A utility token uses a distributed ledger or blockchain platform to provide access rights to a specific product or service or to be used to purchase specific products or services.

- Security Tokens: Security tokens allow businesses to raise money to fund an idea or business model. The business offers security tokens in exchange for fiat money or other crypto assets.

- The security token often comes with a stake in the project and additional benefits, such as voting rights, profit sharing or dividends.

- Non-Fungible Tokens (NFT): It is a token that represents ownership of a unique digital item (like a work of art, a government ID, a specific unit of production).

- An NFT certifies that the holder owns the underlying digital asset and can sell, trade or redeem it.

Regulation of Cryptos in India

- At the moment, there is no legislature that covers cryptocurrencies in India. However, owning cryptocurrencies is still not illegal.

- As of now, a 30% tax on income from virtual assets was announced.

- The Union Government had also sought to introduce the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 which seeks to prohibit all private cryptocurrencies in India.

IMF’s Crypto Action Plan

- Safeguard monetary sovereignty and stability by strengthening monetary policy frameworks and do not grant crypto assets official currency or legal tender status.

- Guard against excessive capital flow volatility and maintain effectiveness of capital flow management measures.

- Analyze and disclose fiscal risks and adopt unambiguous tax treatment of crypto assets.

- Establish legal certainty of crypto assets and address legal risks.

- Develop and enforce prudential, conduct, and oversight requirements to all crypto market actors.

- Establish a joint monitoring framework across different domestic agencies and authorities.

- Establish international collaborative arrangements to enhance supervision and enforcement of crypto asset regulations.

- Monitor the impact of crypto assets on the stability of the international monetary system.

- Strengthen global cooperation to develop digital infrastructures and alternative solutions for cross-border payments and finance.

What is CARF?

- The Crypto-Asset Reporting Framework (CARF) is a global tax reporting framework for cryptocurrencies.

- This framework will help keep track of cross-border transactions of crypto assets.

- It has been released by the Organisation for Economic Cooperation and Development (OECD).

Major Shortcomings in Crypto Assets

- Price Volatility: Crypto-assets have no underlying claim, such as the right to a future cash flow or to discharge any payment obligation, and they lack fundamental value.

- Governance Risks: It involves the lack of transparency and absence of regulatory authority.

- Cyber Risks: Cryptocurrency for its characteristic of being a digital mode of transaction has become a very common platform for hackers, terror finance, and drug transaction.

- Scalability Concern: The scalability of crypto remains a major concern, since it is based on blockchain technology, which has a limited storage capacity.

- Money Laundering: There is a huge possibility that people might start investing in money laundering and it is very easy as one can send money from country to country without any accountability.

- Economic Disbalance: Rising crypto currency market can disbalance the circular flow of money in the economies.

- No definite Mechanism: Unlike equities or currencies, cryptos are not subject to a definite mechanism. Central banks would not have any reference point to devise their interest rates in accordance with their domestic requirements.

International Monetary Fund (IMF)

- The IMF was established in 1944 in the aftermath of the Great Depression of the 1930s.

- The IMF has three critical missions: furthering international monetary cooperation, encouraging the expansion of trade and economic growth, and discouraging policies that would harm prosperity.

- It works to achieve sustainable growth and prosperity for all of its 190 member countries.

World Population Day 2025, Themes, Histo...

World Population Day 2025, Themes, Histo...

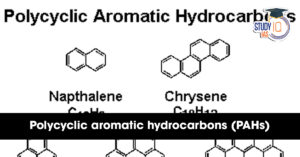

What are Polycyclic Aromatic Hydrocarbon...

What are Polycyclic Aromatic Hydrocarbon...

Marlin Fish: Species, Features, Appearan...

Marlin Fish: Species, Features, Appearan...