Table of Contents

Context: India’s dependence on imports of critical minerals and lack of processing capacity necessitate strategic reforms.

India faces strategic and economic risks in its green transition due to heavy reliance on imports of critical minerals, prompting engagement in international “mineral clubs” for supply security and resilience.

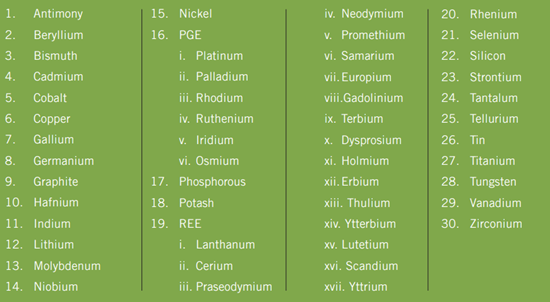

What are Critical Minerals?

- Critical minerals are mineral resources, both primary and processed, that are essential inputs in modern technologies, economies, and national security.

- They are characterised by the risk of supply chain disruption due to non-availability and price volatility.

- These minerals play a crucial role in various industries and sectors and have limited substitutes, making them of strategic importance.

Why India Engages in Minerals Clubs (“Minilaterals”)

- Diversify and Secure Supply Chains: Reduce dependence on China for critical minerals needed for EVs, solar, batteries, and semiconductors.

- Example: Quad Critical Minerals Initiative and Minerals Security Partnership (MSP).

- Collaborative Advantage: Access to advanced technology, finance, and R&D through joint ventures with countries like Japan, Australia, and the US.

- Overcome Domestic Gaps: Indian companies lack extraction technology and face financial constraints; clubs help pool resources and de-risk overseas ventures.

- Market Influence & ESG Standards: Shape global environmental, social, and governance (ESG) standards and supply chain rules, presenting the Global South perspective.

- Championing the Global South: Leverage ties with Africa/Southeast Asia for fairer mineral trade and as a bridge between North and South.

Key Issues and Challenges

- Technology and Investment Gaps: Indian firms struggle with advanced mining tech and financing.

- Hesitancy to invest in unstable jurisdictions abroad.

- Risk of Low Value Addition: India could become only a processing or transit hub, with higher value activities staying in developed countries.

- Protectionism and Uncertain Access: “Friendly stockpiling” agreements can break down due to geopolitical shifts, tariffs, or changing governments.

- Slow Technology Transfer: Developed countries may restrict sharing of cutting-edge tech and IP, as seen in vaccines and clean tech.

- ESG Compliance Pressure: Need to align with high global ESG standards, which can be resource-intensive for Indian firms.

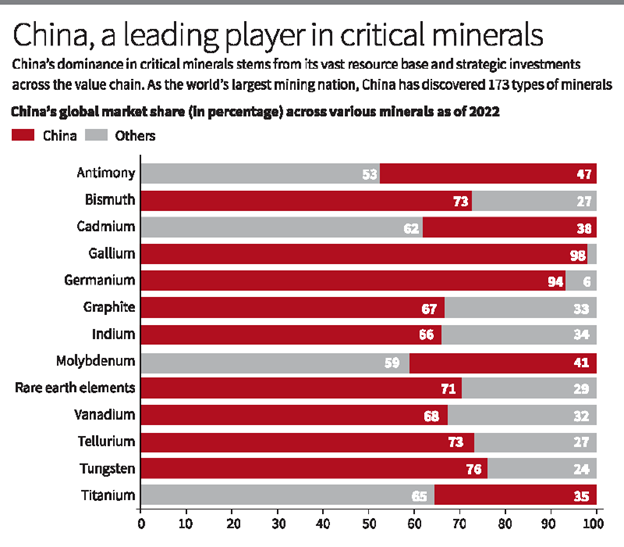

China’s Dominance in Critical Minerals

Resource Base and Investments

- China is the world’s largest mining nation with 173 types of minerals, including:

- 13 energy minerals, 59 metallic minerals, and 95 non-metallic minerals.

- In 2023, China invested $19.4 billion in exploration, discovering 132 new mineral deposits, including 34 large ones.

- Key mineral reserves: copper, lead, zinc, nickel, cobalt, lithium, gallium, germanium, crystalline graphite, and others.

Processing and Refining Capabilities

- Controls 87% of rare earth processing, 58% of lithium refining, and 68% of silicon processing.

- Strategic overseas investments in mining and refining enhance supply chain control.

China’s Strategic Export Controls

Weaponisation of Exports: Targets critical minerals vital for semiconductors, batteries, and high-tech manufacturing.

- Example:

- 2010 rare earth embargo against Japan.

- 2023 restrictions on gallium, germanium, and antimony exports.

- Ban on rare earth extraction and processing technologies in December 2023.

- Strategic Balance: Avoids controlling minerals heavily reliant on Western raw materials.

- Avoids actions disruptive to its domestic industrial and export-dependent sectors.

India’s Dependency on China

Critical Minerals Import Dependency (2019-2024)

- Bismuth (85.6%): Used in pharmaceuticals and chemicals; China controls 80% of global refinery production.

- Lithium (82%): Crucial for EV batteries; China refines 58% of the global supply.

- Silicon (76%): Key for semiconductors and solar panels; advanced processing technology required.

- Titanium (50.6%): Vital for aerospace and defence; diversification exists, but switching costs are high.

- Tellurium (48.8%): Used in solar power and thermoelectric devices; China produces 60% globally.

- Graphite (42.4%): Essential for EV batteries and steel production; China dominates 2% of global output, including battery-grade graphite.

Reasons for India’s Import Dependency

Structural Challenges in Mining

- Critical minerals are often deep-seated, requiring high-risk investments in exploration and mining technologies.

- Lack of incentives and policy support has deterred private sector participation.

Limited Processing Capabilities

- India lacks the advanced technological capacity for extraction and processing.

- Example: Jammu and Kashmir’s lithium deposits (5.9 million tonnes) are in clay form, but India lacks the technology to extract them efficiently.

India’s Efforts to Reduce Dependency

Strategic Initiatives

- KABIL (Khanij Bidesh India Ltd.): A joint venture of three State-owned companies to secure overseas mineral assets.

- Membership in:

- Minerals Security Partnership (MSP).

- Critical Raw Materials Club for diversification and partnerships.

Investments in Research

Collaboration with the Geological Survey of India (GSI) and the Council for Scientific and Industrial Research (CSIR) to develop indigenous technologies.

Circular Economy and Recycling

- Promoting recycling to reduce dependency on virgin minerals.

- Production-linked incentives for critical minerals extraction through recycling.

India’s Position in Critical Minerals

India is highly import-dependent, lacking large domestic reserves.

Key reserves in India

- Lithium: It is found in Jammu & Kashmir, but exploration is at an early stage.

- Rare Earths: India has 5% of global reserves, mainly in Andhra Pradesh and Odisha.

- Graphite: Large reserves in Jharkhand, Odisha, and Arunachal Pradesh.

Current Challenges

- Limited exploration and mining infrastructure.

- Dependence on imports of critical minerals is even greater than oil dependency.

- There is a need for investment in domestic refining and processing facilities.

Lessons for India

- Need for Domestic Exploration: Despite rich geology, India has insufficient mineral exploration.

- Liberalizing the sector and incentivizing private players is crucial.

- Strategic Foreign Partnerships: India has been signing supply agreements with friendly countries but must secure long-term partnerships to ensure resource security.

- Developing a Self-Sufficient Manufacturing Base: India’s ambition to become a global manufacturing hub (EVs, renewables, electronics) requires a steady supply of critical minerals.

- Encouraging domestic refining and processing will reduce reliance on China.

- Policy Reforms for Mineral Security: Allow private companies to monetize their mineral discoveries as per global best practices.

- Strengthening public-private partnerships in mining and refining is essential for long-term self-sufficiency.

Challenges in India

- Complete Import Dependence for Key Minerals: 100% dependent on imports for lithium, cobalt, rare earths, nickel, and silicon.

- Underdeveloped Domestic Resource Base: Exploration still in early stages; mining potential untapped or ecologically constrained.

- Midstream Processing Bottlenecks: Limited refining and conversion capacity (e.g., battery-grade lithium or cobalt), leading to reliance on China.

- Auction Failures and Low Private Participation: High capital costs, technical expertise shortages, and weak investor confidence have led to several annulled mineral block auctions.

- Vulnerable Supply Chains: China’s dominance (e.g., 90% of rare earth refining) and export restrictions impact India’s manufacturing and EV sectors.

- Social Resistance: Several critical mineral reserves lie in tribal or ecologically sensitive areas where inadequate ESG compliance has led to delays, protests and legal challenges.

Importance of Critical Minerals

- Strategic for Clean Energy Transition: Essential for solar panels, wind turbines, EV batteries, and green hydrogen technologies.

- Enable India’s energy security and net-zero ambitions.

- Backbone of Advanced Manufacturing: Crucial for semiconductors, electronics, robotics, defense equipment, and aerospace.

- Enabler of Digital and Technological Sovereignty: Support AI, data centers, satellites, telecom, and high-tech industries.

- Supply Chain Resilience and National Security: Reduce dependence on politically sensitive supply chains, especially China’s.

- Economic Growth Driver: Unlocks potential for value addition, job creation, and industrial diversification.

- Geopolitical Leverage: Aligns with India’s role in global supply chain coalitions (e.g., Quad, G20, Mineral Security Partnership).

Why Critical Minerals Play a Crucial Role in Geopolitics?

- Foundation of Future Technologies: Critical minerals like lithium, cobalt, nickel, and rare earth elements are essential for electric vehicles (EVs), semiconductors, renewable energy, and advanced defense systems.

- Nations that control these resources have leverage over global supply chains and technological advancements.

- US-China Strategic Rivalry: China dominates 75% of the global rare earth supply and controls key refining facilities.

- The US is highly dependent on imports, making it vulnerable to supply disruptions, similar to oil dependence in the past.

- Weaponization of Supply Chains: Countries can restrict mineral exports as a geopolitical tool.

- Example: China banned the export of key rare earth processing technologies in 2023, limiting competitors’ access.

- Energy Transition & National Security: The global shift to clean energy (solar, wind, EVs) increases demand for critical minerals.

- Nations without secure supply chains risk falling behind in industrial and defense capabilities.

- Economic Leverage & Resource Wars: Countries rich in minerals (e.g., Ukraine, Greenland, Democratic Republic of Congo) become strategic battlegrounds for resource control.

- Example: The US seeks greater access to Ukraine’s lithium and graphite reserves to reduce dependence on China.

- Strategic Alliances & Supply Chain Diversification: The US, EU, India, and Japan are forming alliances to secure mineral supplies.

- India is signing agreements with Australia, Argentina, and African nations to reduce import dependence.

Way Forward

- Sustained Investments: Addressing mining and processing challenges requires long-term commitment.

- Diversification: Expand partnerships to reduce reliance on Chinese supplies.

- Enhancing Indigenous Capabilities: Develop technological capacity for extraction and refining critical minerals.

- Negotiate R&D and Tech Transfer Clauses: Ensure mineral agreements include mandatory investment in Indian R&D, technology access, and academic exchanges.

- Strengthen Domestic Capacity: Invest in advanced exploration, mining, and refining capabilities at home; scale up battery, EV, and material manufacturing.

- De-risk Overseas Ventures: Develop blended finance and export credit mechanisms to support Indian companies abroad, especially in risky countries.

- Clear, Reciprocal Agreements: Push for transparent governance, defined access rights, and protection from abrupt restrictions in mineral clubs.

- Lead ESG Standard-Setting: Use club membership to advocate for ESG standards reflecting India’s context and the broader Global South.

- Integrate Value Chains: Promote vertical integration from mining to manufacturing, preventing India from being just a demand centre.

- Balance Global and Domestic Priorities: Ensure all international partnerships complement India’s “Make in India” and “Atmanirbhar Bharat” goals.

- Strengthen the National Critical Mineral Mission (NCMM): Focus on seamless execution, clear accountability, and measurable outcomes.

- Accelerate Domestic Exploration: Expedite GSI-led surveys and simplify clearances for strategic reserves.

- Use PLI-like Incentives: Encourage private players to set up midstream facilities for value-added processing.

- Strengthen Global Partnerships: Expand bilateral collaborations (e.g., Australia, Argentina) and deepen involvement in MSP, Quad.

- Implement ESG Frameworks: Mandatory third-party audits, environmental safeguards, and community benefit-sharing models.

Geological Heritage Sites of India: Sign...

Geological Heritage Sites of India: Sign...

Places in News for UPSC 2026 for Prelims...

Places in News for UPSC 2026 for Prelims...

Lake Natron: Location, Features, Wildlif...

Lake Natron: Location, Features, Wildlif...