Table of Contents

In the dynamic world of banking and finance, ensuring stability during economic ups and downs is critical. One major tool developed for this purpose is the Countercyclical Capital Buffer (CCyB). Though introduced by the Reserve Bank of India (RBI) in 2015 under the Basel III framework, India has not activated it yet. However, understanding this important regulatory tool is essential for anyone following banking reforms, financial stability, or preparing for competitive exams like UPSC, RBI Grade B, and banking exams.

Here’s everything you need to know about CCyB its purpose, features, indicators, and significance.

What is the Countercyclical Capital Buffer (CCyB)?

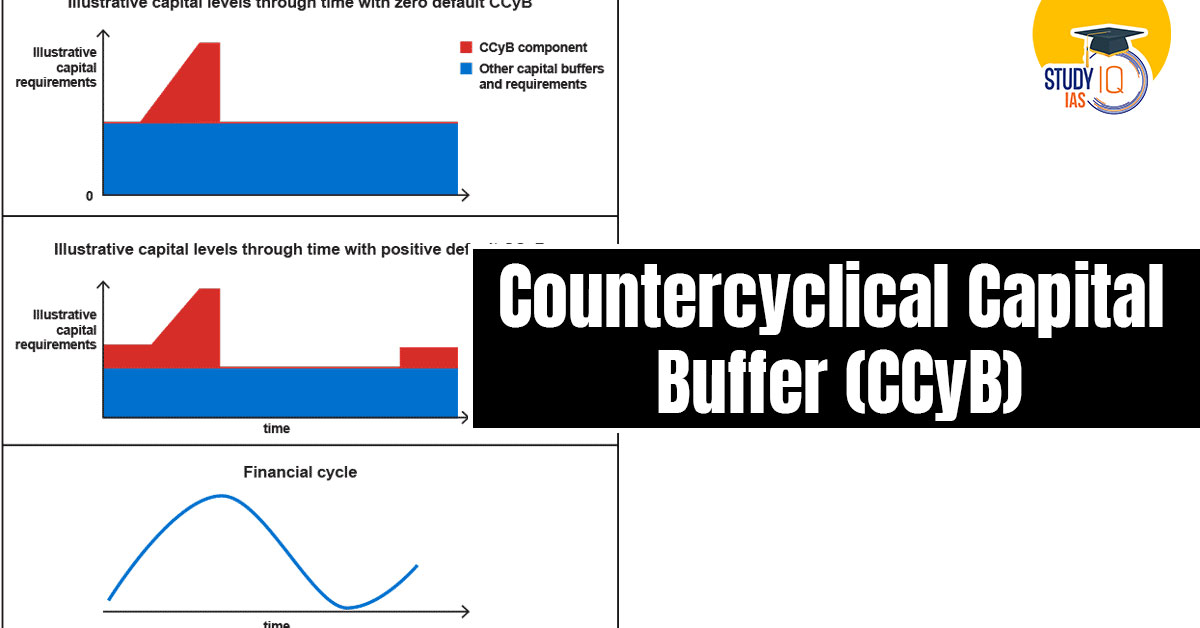

The Countercyclical Capital Buffer (CCyB) is a regulatory tool designed to ensure that banks build up extra capital buffers during good economic times (when credit growth is high) so that they can absorb potential losses and continue lending even during economic downturns.

In simpler words, it acts like a financial “savings account” for banks, saving during boom times so that they can survive during busts.

Purpose of the CCyB

The main objectives of implementing the Countercyclical Capital Buffer are:

-

Maintain Credit Flow During Stress: Ensure that banks can continue to provide credit to businesses and households even during financial crises.

-

Curb Indiscriminate Lending: Prevent banks from taking excessive risks or indulging in uncontrolled lending when times are good and credit is expanding rapidly.

-

Enhance Banking Sector Resilience: Strengthen the ability of banks to withstand periods of financial and economic stress without collapsing.

Essentially, CCyB promotes sustainable credit growth and financial system stability.

Key Features of the CCyB

-

Capital Requirement: Banks must accumulate additional capital (mainly Common Equity Tier 1 capital) during periods of excessive credit growth.

-

Flexibility: The buffer requirement can be increased or decreased based on the economic cycle.

-

Gradual Build-up: The CCyB is built up during boom periods and released during busts.

-

Application: It applies to all banks operating in a jurisdiction, whether domestic or foreign.

Main Indicator: Credit-to-GDP Gap

The Credit-to-GDP gap is the primary indicator used to guide decisions on the activation of CCyB.

-

Credit-to-GDP Gap measures the difference between the current credit-to-GDP ratio and its long-term trend.

-

A large positive gap typically signals excessive credit growth, indicating that it may be time to build up buffers.

Other supplementary indicators include:

-

Asset prices (e.g., real estate prices)

-

Credit spreads

-

Non-performing asset (NPA) levels

-

Banking sector profitability

This ensures a holistic view of financial sector health before implementing CCyB measures.

CCyB in India: Status So Far

-

The Reserve Bank of India (RBI) introduced the CCyB framework in 2015, in line with the Basel III guidelines.

-

However, the CCyB has never been activated in India so far.

-

The RBI reviews the necessity of activating the CCyB periodically based on the Credit-to-GDP gap and other risk assessments.

Given the cautious lending practices and moderate credit growth in India over the years, RBI has not found it necessary to trigger the CCyB yet.

Why is CCyB Important?

The Countercyclical Capital Buffer is crucial for several reasons:

-

Crisis Prevention: It helps prevent financial crises by reducing risky lending behavior during boom periods.

-

Shock Absorption: Banks with higher capital reserves are better equipped to survive shocks without collapsing.

-

Economic Stability: By maintaining the flow of credit during downturns, CCyB supports economic activity and employment.

-

Investor Confidence: Strong capital positions enhance trust among depositors, investors, and regulators.

Conclusion

The Countercyclical Capital Buffer (CCyB) is a vital tool for safeguarding the banking sector and ensuring financial system stability. Although it has not been activated in India yet, its presence underlines the country’s commitment to international best practices in banking regulation.

As India’s economy grows and becomes more complex, understanding and effectively using tools like CCyB will be key to navigating future financial cycles successfully.

5 Years of SVAMITVA Scheme and Its Benef...

5 Years of SVAMITVA Scheme and Its Benef...

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...

STELLAR Model: A Game-Changer in Power S...

STELLAR Model: A Game-Changer in Power S...