Table of Contents

Contingency Fund of India

The Contingency Fund of India is a reserve for emergency expenses, giving the government financial flexibility to handle unexpected situations.

- Money is added to the fund as outlined in the Contingency Fund of India Act, 1950.

- This fund is used for urgent and unexpected expenses.

- The fund is managed by executive action until approved by Parliament. It is under the control of the President of India and managed by the Finance Secretary.

The Contingency Fund of India is an important part of Indian Polity which an important subject in UPSC Syllabus. Students can also go for UPSC Mock Test to get more accuracy in their preparations.

Contingency Fund of India Meaning

The Constitution allows Parliament to create the “Contingency Fund of India,” which is funded periodically. This led to the India Contingency Fund Act in 1950, establishing a fund of ₹500 crores under Article 267.

In 2005, the fund’s value increased from ₹5 crore to ₹500 crore. The President of India can allocate funds from this contingency fund after consulting the Union Cabinet and getting Parliament’s approval. The Finance Secretary manages the fund, which operates like the Public Account of India.

Additionally, Article 267(2) requires each State Government to set up its own contingency fund, allowing the Governor to use it for urgent expenses before receiving approval from the State Legislature.

| Article 267 in Part XII |

| Article 267 in Part XII of the Indian Constitution provides for the establishment of the Contingency Fund of India. |

Who Manages the Contingency Fund of India?

Parliament set up the Contingency Fund of India in 1950 through the “Contingency Fund of India Act” to cover unexpected financial needs it is like a rainy day fund. The finance secretary manages this fund on behalf of the President, and it operates under the President’s direction. However, the government cannot withdraw money without Parliament’s approval.

Contingency Fund of India Amount

According to Article 267 of the Indian Constitution, a corpus must be established under the contingency fund of India to manage emergency situations. The permanent money held for the costs necessary for the management and survival of the country is referred to as the corpus. This sum may occasionally increase.

The initial capital for India’s contingency fund was Rs 5 crore; in 2005, it was raised to Rs 500 crores, or Rs 5 billion. The finance bill 2021 was recently recommended as a way to increase India’s contingency reserve from Rs 500 crore to Rs 30,000 crore. Additionally, the government changed the contingency fund of India’s regulations so that the finance secretary could access 40% of the total corpus.

To preserve the corpus, any spending or withdrawal from the contingency fund needs to be approved by the legislature. The state legislature must also approve all expenditures from the state contingency fund. Additionally, the state legislature of each Indian state determines the amount of the state contingency fund corpus, which varies.

Contigency Fund at State Level

The Contingency Fund of India at the state level is established under Article 267(2) of the Constitution, which requires each State Government to create its own fund. This fund allows the Governor to access advances to cover unforeseen expenses while waiting for approval from the State Legislature.

Contingency Fund of India Benefits

Making an emergency fund is the best strategy to handle monetary difficulties. Here is the list a few advantages of maintaining a contingency fund below.

Protects Against New Debt

Without a contingency fund, country will be forced to borrow money—possibly at high interest rates—to cover these unforeseen costs. This could drastically jeopardize your financial strategy while also forcing you to make enormous interest and principle payments that would take years to repay.

Reduces Stress

Sudden cash outflows due to an emergency can have a significant negative psychological and emotional impact in addition to messing up your budget. Add insult to injury by capping it off with a high-interest loan to pay for unforeseen costs. With a contingency fund Country can rest assured of paying up any unforeseen expenses.

Better Decision Making

The ideal scenario is to keep a separate emergency account from your primary banking account. It becomes simpler to determine whether to indulge on those few occasions if you have properly designated your cash for covering living expenses, savings, and contingencies.

Meet Financial Goals

You can cover unforeseen expenses with the help of a contingency fund without jeopardizing your capacity to pay your living expenses. As a result, you can carry out your long-term investment plans and continue working towards your financial objectives. As and when your emergency fund is depleted due to unforeseen expenses, you can also make plans for how to replenish it.

Consolidated Fund vs Contingency Fund vs Public accounts

| Consolidated Fund | Contingency Fund | Public Accounts |

| It comes under Article 266 (1) | The central contingency fund was comes under Article 267 (1) of the Indian constitution, whilst each state government’s contingency fund was established under Article 267 (2). | It was established under Article 266 (2) |

| It is the most important fund out of all three and makes up all the revenue (taxable and non-taxable) of the Indian government. | The fund is kept to meet unforeseen expenditures during a crisis. | In this, the government acts like a banker in these transactions, and the funds in it do not belong to the government. They ought to be paid back to the rightful owners at some time in the future. |

Examples of consolidated funds include:

|

Funds used during a natural calamity or war are taken from the contingency fund. | Examples of public accounts include

|

| It requires authorization from the parliament pre-expenditure. | The President can withdraw funds from the Contingency Fund during a crisis, but must get parliamentary approval afterward. Similarly, state governors can access state contingency funds in emergencies, but need approval from the state legislature later. | Its expenditure does not require any authorization from the parliament and is executed by the President of India. |

Importance of the Contingency Fund of India

- Financial Flexibility: The fund gives the government quick access to money for unexpected expenses, ensuring urgent needs are met without delays.

- Quick Response: It allows the government to act fast during emergencies like natural disasters or economic crises, without waiting for parliamentary approval.

Contingency Fund of India UPSC

The Consolidated Fund of India (Article 266), the Contingency Fund of India (Article 267), and the Public Accounts of India (Article 266) are the three funds established under the Indian Constitution and are crucial parts of the Indian government’s financial management. One of these is the contingency fund, which is used for catastrophe management by both the federal government and state governments. Students can read all the details related to UPSC by visiting the official website of StudyIQ UPSC Online Coaching.

Fundamental Rights of Indian Constitutio...

Fundamental Rights of Indian Constitutio...

Waqf Act (Amendment) 2025: Key Highlight...

Waqf Act (Amendment) 2025: Key Highlight...

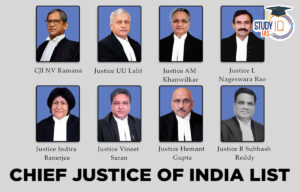

Justice BR Gavai will take oath as 52nd ...

Justice BR Gavai will take oath as 52nd ...