Table of Contents

Context

- The Supreme Court ruled that lawyers, as professionals, cannot be subjected to legal proceedings for providing faulty services under the Consumer Protection Act 2019 (CPA).

- However, it rejected similar arguments for medical professionals and decided that its judgement in Indian Medical Association vs V P Shantha (1995) should be referred to a larger bench for reconsideration.

Indian Medical Association vs V P Shantha (1995):

- Supreme Court Ruling: In 1995, a three-judge bench of the Supreme Court ruled that doctors fall under the purview of the consumer protection law.

- Medical Negligence Lawsuits: This ruling allows for the filing of medical negligence lawsuits against doctors for deficiency in service.

- Recognition of Skilled Work: The court acknowledged that medical professions involve “skilled” work, which sets them apart from other occupations.

- Factors Beyond Control: The court also noted that the success of medical treatment often depends on factors beyond the doctor’s control.

About Consumer Protection Act, 2019

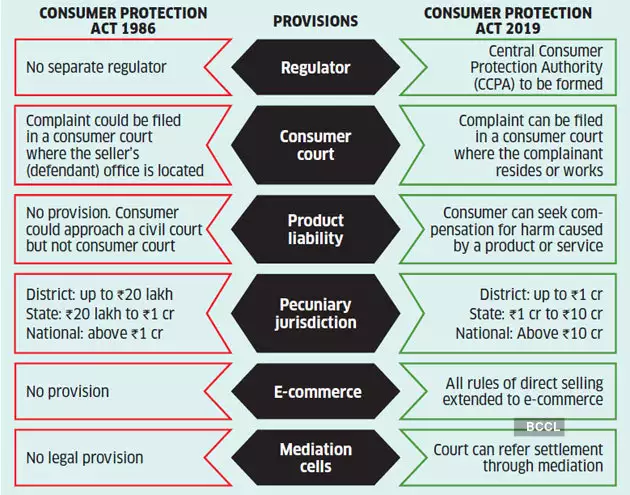

- Introduced: It was first introduced in 1986 and it was subsequently repealed and a new act was introduced in 2019.

- Objectives:

- To provide effective protection of the interests of consumers.

- To establish authorities for timely and effective administration and settlement of consumer disputes.

Key Features of Consumer Protection Act

- Central Consumer Protection Authority (CCPA):

- The Act establishes the CCPA to promote, protect, and enforce the rights of consumers.

- It has the authority to conduct investigations into violations of consumer rights, file complaints/prosecute, order recall of unsafe goods and services, order discontinuation of unfair trade practices and misleading advertisements, and impose penalties.

- Consumer Disputes Redressal Commission:

- The Act provides for the establishment of Consumer Disputes Redressal Commissions at the District, State, and National levels.

- The pecuniary jurisdiction of these commissions is defined:

- District Commission: Up to ₹1 crore.

- State Commission: ₹1 crore to ₹10 crore.

- National Commission: Above ₹10 crore.

- E-commerce Rules:

- The Act includes provisions specific to e-commerce and online shopping, mandating e-commerce entities to comply with certain requirements to ensure consumer protection.

- E-commerce companies must disclose seller details, address consumer complaints promptly, and avoid unfair trade practices.

- Product Liability:

- Introduced the concept of product liability, holding manufacturers, service providers, and sellers accountable for any harm caused to consumers due to defective products or deficient services.

- Consumers can claim compensation for harm caused by defective products or services.

- Unfair Trade Practices:

- The Act defines and prohibits unfair trade practices such as false representation of goods/services, misleading advertisements, etc.

- It empowers consumers to file complaints against such practices.

- Alternate Dispute Resolution:

- The Act encourages mediation as an alternative dispute resolution mechanism for consumer disputes.

- A Mediation Cell is established attached to the Consumer Commissions at the district, state, and national levels.

- Simplified Complaint Filing:

- The Act allows consumers to file complaints electronically and through video conferencing, making the process more accessible and consumer-friendly.

- Complaints can be filed at the place of residence or work of the consumer.

Consumer Protection Act 1986 vs. 2019

Recent Scenario

- Supreme Court’s View on Professionals:

- The Supreme Court opined that professionals, such as lawyers and doctors, should not be held to the same standard as other occupations.

- The court emphasised that the Consumer Protection Act (CPA) was intended to protect consumers from unfair trade practices and unethical business practices only.

- The legislature did not intend to include professionals within the purview of the Act.

- Definition of ‘Service’ in CPA:

- The CPA (both 1986 and 2019 Acts) excludes two types of services:

- Services provided free of charge.

- Services rendered under a ‘contract of personal service.’

- The CPA (both 1986 and 2019 Acts) excludes two types of services:

- Types of Medical Services:

- The court identified three types of medical services:

- Services provided free of cost to everyone.

- Paid services available to everyone.

- Services exempting certain categories of people who cannot afford to pay.

- The first type (free of cost to everyone) is not included under the CPA.

- The second type (contract of personal service) is considered a service under the CPA.

- For the third type, the court ruled that hospitals and doctors providing services to exempted categories will be considered as providing ‘service’ under the CPA, regardless of whether it is free or not.

- The court identified three types of medical services:

- Doctor-Patient Relationship:

- The court held that medical care is not provided under a ‘contract of personal service.’

- A ‘contract of personal service’ involves an employer-employee or a “master and servant” relationship.

- Since there is no such relationship between a doctor and a patient, the contract between a medical practitioner and their patient cannot be treated as a contract of personal service.

List of Chief Ministers of Jammu and Kas...

List of Chief Ministers of Jammu and Kas...

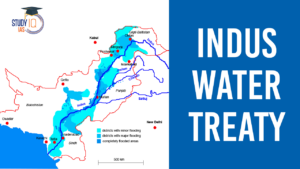

Cabinet Committee on Security Suspends I...

Cabinet Committee on Security Suspends I...

Pahalgam Terror Attack: All Eyes on Paha...

Pahalgam Terror Attack: All Eyes on Paha...