Table of Contents

Context: The Budget consists of three major components: expenditure, receipts and deficit indicators.

Fundamentals of Budget-Making

- Constitution: According to Article 112 of the Indian Constitution, the Union Budget of a year is a statement of the estimated receipts and expenditures of the government for that particular year.

- It is also referred to as the Annual Financial Statement.

- Objective: To bring about rapid and balanced economic growth in our country coupled with social justice and equality.

- It is expected that as the size of the Union Budget increases, the higher government expenditure will push the economy forward.

- Preparation: The Indian Union Budget is prepared by the Ministry of Finance in consultation with NITI Aayog and other concerned ministries.

- The budget division of the Department of Economic Affairs (DEA) in the Finance Ministry is the nodal body responsible for producing the Budget.

- Until 2016, the Union Budget was presented on the last day of February, however, that has changed to the first of February.

- Furthermore, the Railway Budget which was presented separately a day before the final Budget was merged with the Union Budget after 2016.

India’s First Budget

- The Budget was first introduced in India on April 7, 1860, when Scottish economist and politician James Wilson from the East India Company presented it to the British Crown.

- Independent India’s first budget was presented on November 26, 1947, by the then Finance Minister RK Shanmukham Chetty.

Significance of Union Budget

| Aspect | Details |

| Ensure efficient allocation of resources: |

|

| Reduce unemployment and poverty level: |

|

| Reduce wealth and income disparities: |

|

| Keep a check on prices: |

|

| Change tax structure |

|

Classification of Union Budget

| Revenue budget | Capital Budget |

|

|

Key Concept of Union Budget

Gross Domestic Product (GDP)

- It is the value of the goods and services produced within the country during a year. GDP is the measure of the country’s economic output.

- In India, contributions to GDP are largely divided into three sectors – agriculture, industry, and services.

- Nominal GDP (or what will the size of the economy be next year): It is the total market value of all the goods and services produced in India in a financial year.

- Real GDP: It is “derived” from the nominal GDP by removing the effect of inflation.

- Capital Expenditure: Used for creating durable assets or reducing liabilities.

- Examples: Constructing schools, hospitals, and infrastructure projects.

- Revenue Expenditure: Does not add to assets or reduce liabilities.

- Examples: Payment of wages, salaries, subsidies, and interest payments.

- Development Expenditure: Sum of economic and social services expenditures.

Fiscal Deficit (or how much money can the government borrow?)

- A fiscal deficit is a condition when the expenditure of the government exceeds its revenue in a year.

- The fiscal deficit is calculated as the total revenue generated minus the total expenditure.

- Government revenue comes from revenue receipts, recovery of loans and other receipts of the government.

- While most countries continue to project a deficit in their economies, a surplus is rare.

Different Types of Deficits

- Fiscal Deficit: It is the difference between the Revenue Receipts plus Non-Debt Capital Receipts (NDCR) and the total expenditure.

- It is reflective of the total borrowing requirement of the Government.

- It also indicates the additional number of financial resources needed to meet government expenditure

- Revenue Deficit: It refers to the excess of revenue expenditure over revenue receipts.

- Revenue deficit = Total Revenue expenditure – Total Revenue

- Effective Revenue Deficit: It is the difference between Revenue Deficit and Grants for Creation of Capital Assets.

- Primary Deficit: It is measured as a Fiscal Deficit with less interest payments.

- It shows the borrowing requirements of the government for meeting expenditures excluding interest payments.

Total Revenues

- It is the amount of money, a government can raise on its own.

- There are three main ways to raise revenues —

- Tax revenues (by levying taxes),

- Non-tax revenues (such as the dividends earned by government-owned enterprises etc.).

- Money raised through disinvestment of public sector undertakings.

Receipts – Types of Receipts

- Revenue Receipts: Do not increase liabilities.

- Includes tax revenue (GST, income tax, corporate tax, excise, customs, etc.) and non-tax revenue (dividends, fees, fines, grants).

- Non-Debt Capital Receipts: Do not create liabilities or future obligations.

- Examples: Recovery of loans, disinvestment proceeds.

- Debt-Creating Capital Receipts: Involve higher liabilities and future repayment commitments.

Important Terms in Budget

- Fiscal Policy: Fiscal policy refers to the actions taken by the government to manage its spending and revenue collection (through taxes) to achieve its economic objectives.

- Consolidated Fund: The Consolidated Fund of India is a crucial government account that includes revenues received and expenses incurred during a financial year, with the exception of exceptional expenses such as disaster management.

- All non-exceptional government expenditure is made from this fund.

- Inflation: Inflation refers to the rate at which the overall cost of goods and services in an economy is rising.

- The Current Account Deficit (CAD) is the shortfall between the money received by selling products to other countries and the money spent to buy goods and services from other nations.

- Divestment: Governments resort to divestment generally as a way to pare losses or to raise revenues.

- This could be from a non-performing asset, a loss-making company.

- This helps the government in raising non-tax revenue and to exit loss-making ventures.

- An interim budget or a ‘vote of account’ announced generally during an election year.

- The interim budget comprises a complete set of accounts including both revenue and expenditure.

- However, after the success of an election, the winning government announces the full budget later on and changes are possible in the final document than those presented in the interim budget.

- The interim budget is the estimates of accounts for the next two to four months.

| UPSC PYQ |

There has been a persistent deficit budget year after year. Which of the following actions can be taken by the government to reduce the deficit? (2015)

Select the correct answer using the code given below.

Answer: A |

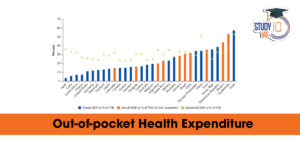

Out-of-Pocket Health Expenditure, Reason...

Out-of-Pocket Health Expenditure, Reason...

Treasury Bills (T-bills): RBI Cuts Holdi...

Treasury Bills (T-bills): RBI Cuts Holdi...

Fisheries Sector in India, Current Statu...

Fisheries Sector in India, Current Statu...