Coconut Oil Taxation in India

- Background: The dispute was on whether coconut oil, packaged in quantities from 5 ml to 2 litres, should be taxed as edible oil or hair oil

- Prior to GST Regime:

- Taxation Under the CET Act, 1985: Prior to GST, coconut oil was taxed under the Central Excise Tariff Act, 1985 (CET Act).

- In 2005, the CET Act classified coconut oil under Section III as “Animal or Vegetable Fats and Oils” with an 8% excise duty, distinguishing it from haircare products under Section VI, which carried a 16% excise duty.

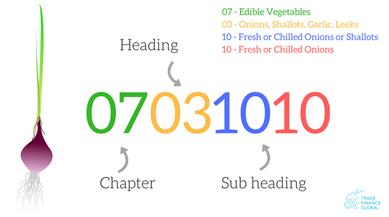

- These classifications followed international norms set by the Harmonised System of Nomenclature (HSN) by the World Customs Organisation.

| World Customs Organisation (WCO) |

Harmonized System of Nomenclature Code (HSN)It is a six-digit identification code developed by WCO in 1988. It helps in systematic classification of goods across the globe.

|

- After introduction of GST:

- Coconut oil was categorized under edible oils, attracting a 5% tax.

- Haircare products under the category “Preparations for use on the hair” continued to attract a higher tax rate of 18%.

| Facts |

|

PAC Report on GST Reforms and Recommenda...

PAC Report on GST Reforms and Recommenda...

Regional Rural Banks in India, Objective...

Regional Rural Banks in India, Objective...

Micro, Small and Medium Enterprises (MSM...

Micro, Small and Medium Enterprises (MSM...