Table of Contents

China’s Restriction on Export of Critical Minerals: Introduction

Antimony, a critical mineral used in strategic sectors such as defence, for military equipment such as missiles, infrared sensors, flares, ammunition, and even nuclear weapons.

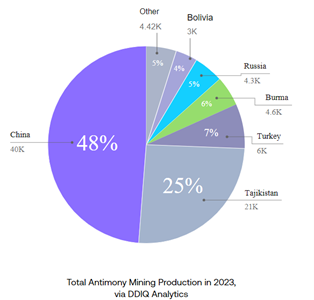

China controls:

- 48% of global antimony and 60% of critical minerals production.

- Accounts for 63% of U.S. antimony imports.

- 60% of rare earth production and 80% of processing worldwide.

Impact on Global Supply Chains

The implications of these restrictions are profound:

- Supply Shortages: The anticipated reduction in antimony availability could lead to severe shortages in critical industries like defence and electronics.

- Price Increases: Prices for antimony have already surged this year, doubling since January and potentially reaching $30,000 per metric ton due to stockpiling by buyers.

China’s Coercive Use of Critical Minerals

- 2010 Incident: China’s coercive use of critical minerals first gained international attention in 2010 when it halted exports of rare earth elements to Japan following a maritime incident involving a Chinese trawler and Japanese Coast Guard boats.

- This incident highlighted global dependence on China for strategic minerals and fueled discussions about the need for alternative supply chains.

Series of Countermoves by China in 2023

- Restrictions on Gallium and Germanium: In 2023, after the Netherlands restricted semiconductor equipment exports under U.S. pressure.

- In response, China imposed curbs on gallium and germanium, both essential for solar cells and computer chips.

- Export Controls on Graphite: In response to U.S. export controls on advanced computing and semiconductor manufacturing, China restricted exports of high-purity synthetic graphite and natural flake graphite, critical for EV batteries, fuel cells, and nuclear reactors.

- Rare Earth Processing Technologies: China restricted the export of rare earth processing technologies, essential for making rare earth magnets used in EVs.

- This move hindered the U.S.-led efforts to build an alternative supply chain.

Strategic Implications of China’s Actions

- Historical Comparison: China’s approach mirrors classic statecraft strategies, such as the U.S. oil embargo against Japan in 1940, aiming to exploit strategic weaknesses.

- Weaponization of Critical Minerals: China’s actions indicate a shift from politicisation to the weaponization of critical minerals, using export controls as a foreign policy tool.

- By demonstrating its control over supply chains, China aims to remind Western nations of their dependency while also retaliating against U.S. actions that threaten its interests.

India’s Vulnerability

India remains particularly vulnerable due to its reliance on imports of critical minerals such as lithium, nickel, cobalt, and copper:

- In FY23, India incurred an import cost of approximately ₹34,000 crore for these minerals.

- As demand continues to grow, India’s vulnerability is expected to increase unless proactive measures are taken.

Conclusion

China’s recent restrictions on critical minerals underscore the geopolitical significance of resource control. This episode serves as a wake-up call for countries, particularly those heavily dependent on Chinese mineral supplies, to re-evaluate their strategies and build more resilient supply chains to safeguard their strategic interests.

India-Bangladesh Relation, Areas of Coop...

India-Bangladesh Relation, Areas of Coop...

India China Relations, Evolution, Areas ...

India China Relations, Evolution, Areas ...

Africa’s Nuclear Energy Market Status ...

Africa’s Nuclear Energy Market Status ...