Context: The article is primarily discussing China’s economic challenges and its approach to addressing these challenges over a period of time. It discusses China’s historical approach to economic growth, the challenges it faced in maintaining high growth rates, and the need for a transition to a more sustainable economic model. It also touches on issues related to regulatory oversight and the role of leadership in shaping economic policies.

Decoding the Editorial

- Wen Jiabao’s Warning (2007): The article starts by referring to a statement made by the former Premier Wen Jiabao in 2007 who had pointed out that China’s economic growth was unstable, unbalanced, uncoordinated, and unsustainable. This implied that there were fundamental issues with China’s economic model that needed to be addressed.

- Post-2008 Global Financial Crisis Strategy: Following the global financial crisis in 2008, China adopted a strategy of investing heavily in infrastructure, including railways, highways, and energy and construction sectors. This approach was taken to maintain high growth rates but did not address core problems such as low consumption, regional inequality, and a lack of social security.

- Leadership’s Dependence on Economic Prosperity: The article suggests that the Chinese leadership has historically depended on delivering economic prosperity to a growing number of citizens to maintain its domestic legitimacy. This pressure to sustain high growth rates influenced China’s policy decisions.

- Challenges Under Xi Jinping’s Leadership: As Xi Jinping came to power, the unsustainable growth model had reached its limits. The “steroids” used to sustain growth were no longer effective, and the transition to a more balanced and sustainable economy became more challenging.

- Lack of Regulatory Oversight: The major issue in Chinese financial markets is particularly the lack of regulatory oversight. Loans to businesses were distributed based on personal networks and relationships, known as “Guanxi.” This practice had its drawbacks and contributed to economic challenges.

China’s economic challenges and changes in its economic strategy over time:

The article revolves around China’s economic challenges and changes in its economic strategy over time.

- China’s Economic Slowdown: The article begins by mentioning China’s economic slowdown, which has generated mixed reactions and concerns about deflation, which could have negative implications for China and the world.

- Xi Jinping’s Era and the “New Normal”: The article discusses how, under the leadership of Xi Jinping, China recognized the need to transition from the era of high growth driven by exports and infrastructure spending to a “new normal.” This new normal focuses on quality-of-life issues and acknowledges changing public expectations. It also signifies the end of the era of consistently achieving over 10% growth rates.

- Challenges in the Labour Market: It mentions that lower growth rates have led to challenges in the labour market, with rising unemployment numbers, particularly among new graduates. The government is advising students to delay their graduation and pursue additional courses due to the difficulty in finding jobs.

- Rising Labour Costs and Overproduction: During Xi Jinping’s first term, China experienced a cooling of export growth rates, partly due to rising labour costs and increased social security investments. It also points out that certain sectors, such as housing, energy, and construction, have engaged in overproduction, resulting in excess inventory despite supply-side reforms.

- Challenges Despite Reforms: Despite early supply-side reforms that shut down underperforming companies and regulated commodities markets, some sectors have continued overproducing, leading to imbalances in supply and demand.

China’s political and economic choices to counter Economic Challenges:

- Political Economy of China: China’s economic decisions are closely intertwined with its political system. It emphasizes that overcoming China’s current economic challenges requires political choices.

- “Disorderly Expansion of Capital”: There has been “Disorderly expansion of capital “which denotes the concerns about unregulated capital expansion.

- Control over Capital and Innovation: Many scholars have questioned China’s ability to foster true innovation while maintaining control over capitalist activities. This suggests that despite promises made in 2013 to let markets play a greater role in resource allocation, there has been a rollback of those promises under Xi’s leadership.

- Government Interventions: Despite hopes for reduced political interventions in loans and investments, the government has intervened in financial markets, particularly during the stock market turbulence in 2015. It has also tightened the convertibility of the Chinese currency, the RMB, which led to some protests.

- Savings and Social Security Measures: Chinese citizens traditionally save a significant portion of their income. Efforts to reduce excessive saving through social security measures have been slow to yield results.

- Policies such as “Common Prosperity” and “Dual Circulation”: These policies that aimed at wealth distribution (“Common Prosperity”) and boosting domestic consumption and market competitiveness (“Dual Circulation”) have not achieved the desired levels of success.

- Factors Contributing to Economic Slowdown: China’s economic slowdown began around 2015 but was temporarily controlled by government spending on projects like urbanization. Factors such as the U.S.-China trade war, de-risking strategies, and China’s “zero-COVID” policy have further accelerated the economic slowdown.

- Concerns of Investors: Recent data from the second quarter of the year indicate that individuals and companies in China are becoming more cautious with their cash holdings. Investors are also apprehensive about the possibility of a deeper economic slump, leading them to wait for more favourable market conditions.

China’s state-owned enterprises (SoEs) and its economic challenges

- State-Owned Enterprises (SoEs): The state-owned enterprises, or SoEs, have been a problem for China’s political leadership. These entities often have guaranteed contracts and strong political networks that allow them to operate without significant changes to their methods. Additionally, SoEs provide social security to a large number of working and retired workers, making any reforms or changes to them a politically sensitive issue.

- Evergrande Crisis (2020-2023): The Evergrande crisis, which exposed China’s housing bubble and broader issues related to mis regulation and path-dependency. The crisis is seen as symptomatic of problems affecting the Chinese economy as a whole.

Path-Dependency and Economic Concerns: Path-dependency has been a potential cause for a “crash landing” in the Chinese economy. This has been a concern for nearly a decade, and the leadership is aware of it. The middle-income trap, where a country struggles to advance beyond a certain income level, has also been a long-term concern. China’s aspiration to move up the value chain and become a hub for design, not just manufacturing, is seen as a challenging goal. - Economic Growth Comparisons: The article briefly compares China’s estimated economic growth rate of 5% to India’s projected growth rate of 6.1% for 2023. Despite a lower growth rate, China’s larger economy means it would still add more value compared to India, which has a smaller economy.

- Impact on Global Markets: China’s economic stability could influence global markets, including commodities like crude oil, cement, and steel. China’s economic performance has a significant impact on global demand for these commodities.

- Geo-Political Implications: The article concludes by noting that economic instability in China could affect its perception of its rise and its risk appetite on the border. This implies that economic challenges could potentially impact China’s foreign policy and geopolitical dynamics.

SSC CGL Exam 2025 Apply Online Starts Ap...

SSC CGL Exam 2025 Apply Online Starts Ap...

Daily Quiz 19 April 2025

Daily Quiz 19 April 2025

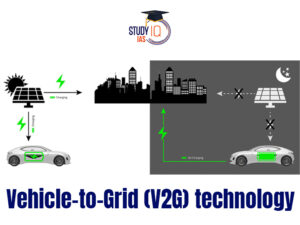

Vehicle-to-Grid (V2G) Technology and its...

Vehicle-to-Grid (V2G) Technology and its...