Table of Contents

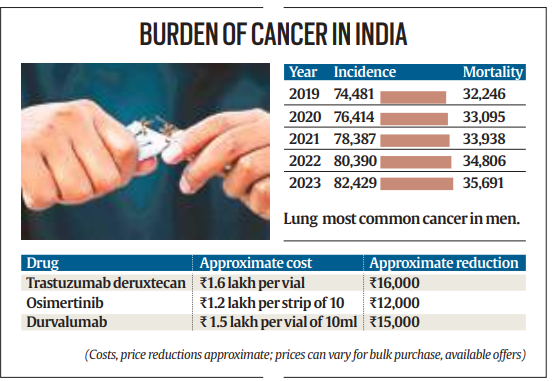

Context: In the 2024-25 budget, the Finance Minister announced customs duty exemptions on three targeted cancer drugs: trastuzumab deruxtecan, osimertinib, and durvalumab.

What is Targeted Cancer Drugs?

- These drugs specifically attack cancer cells while sparing normal cells.

- They focus on genetic changes in cancer cells that help them grow, divide, and spread, leading to better outcomes and fewer side effects compared to traditional chemotherapy.

Examples of Cheaper Cancer Drugs

- Trastuzumab Deruxtecan: Targets the HER-2 receptor and is used for specific breast and gastrointestinal cancers. It is marketed under the brand name Enhertu and costs about Rs 1.6 lakh per vial.

- Osimertinib: Used for lung cancers with epidermal growth factor receptors (EGFR), sold as Tagrisso, and priced at Rs 1.5 lakh per strip of ten pills.

- Durvalumab: An immunotherapy drug for lung, biliary tract, bladder, and liver cancers, available as Imfinzi, costing Rs 1.5 lakh for every 10 ml vial.

Impact of Customs Duty Exemptions

- The exemptions aim to reduce the financial burden on cancer patients and their families by making these high-cost therapies more accessible and affordable.

- Even minor cost reductions can significantly enhance patients’ ability to manage expenses related to additional necessities like nutrition supplements and medical tests.

Cancer Profile in India

- There has been a rising trend in cancer cases in India, with an estimated 14.6 lakh new cases in 2022.

- Breast cancer and lung cancer are the most common types in India, with breast cancer being more prevalent among women and lung cancer more common among men.

- The removal of customs duty on these targeted drugs is crucial due to their effectiveness in treating these prevalent cancers

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...

New Phase of Operation Chakra to Combat ...

New Phase of Operation Chakra to Combat ...

Soyuz Aircraft: History, Design and Sign...

Soyuz Aircraft: History, Design and Sign...