Table of Contents

Context: Recently, the Supreme Court confirmed that States possess the legislative power to impose taxes on minerals in addition to the royalties charged by the Central government.

Background

- 1989 Ruling: A seven-judge Supreme Court bench held that under the Mines and Minerals (Development and Regulation) Act, 1957, and Entry 54 of the Union List, the Centre has primary control over mining regulation. States were only allowed to collect royalties, not impose additional taxes, with royalties classified as taxes.

- 2004 Clarification: A 5-judge bench suggested a typographical error in the 1989 ruling, indicating that royalties were not taxes, leading to a reassessment by a nine-judge bench.

Difference Between Royalty and Tax

- Royalty: Defined as “contractual consideration” paid by the mining lessee to the lessor for mineral extraction rights.

- Tax: Characterised as an “imposition by a sovereign authority,” determined by law and levied by public authorities for funding welfare schemes and public services.

Constitutional Provisions for Mines and Minerals

- Entry 50 of State List: Grants States the exclusive authority to make laws regarding “taxes on mineral rights,” limited by Parliament’s laws on mineral development.

- Entry 54 of Union List: Allows the Centre to regulate “mines and mineral development” in the public interest.

Mines and Minerals (Development and Regulation) Act, 1957

- Primary Objectives:

- Develop the mining industry.

- Ensure conservation of minerals.

- Enhance transparency and efficiency in mineral exploitation.

Key Amendments and Their Features

- 2015 Amendment:

- Auction Method: Introduced mandatory auctioning of mineral concessions to improve transparency in allocation.

- District Mineral Foundation (DMF): Established to benefit communities affected by mining activities.

- National Mineral Exploration Trust (NMET): Created to promote mineral exploration activities.

- Penalties for Illegal Mining: Implemented strict penalties to deter illegal mining practices.

- 2016 and 2020 Amendments: Addressed specific operational challenges within the sector to improve its overall functioning.

- 2021 Amendment:

- Captive and Merchant Mines: Eliminated the distinction between these two types of mines. Captive mines produce minerals for the company’s own use, with provisions to sell up to 50% of their output on the open market after meeting their internal needs. Merchant mines operate to produce minerals for sale on the open market.

- Auction-Only Concessions: Ensured that all mineral concessions in the private sector are awarded through auctions.

- 2023 Amendment:

- Strengthening Mineral Exploration and Extraction: Aimed at enhancing the exploration and extraction of critical minerals vital for India’s economic growth and national security.

- Modification of Atomic Minerals List: Removed 6 minerals from the restricted list of 12 atomic minerals, previously limited to exploration by state agencies, allowing more extensive exploration.

- Introduction of Exploration Licences: Designed to attract foreign direct investment and involve junior mining companies in exploring for deep-seated and critical minerals.

- Strategic Focus on Critical Minerals: Emphasised the importance of minerals like lithium, graphite, cobalt, titanium, and rare earth elements, crucial for future technologies and supporting India’s energy transition and commitment to net-zero emissions by 2070.

India’s Road Safety Crisis: Engineerin...

India’s Road Safety Crisis: Engineerin...

A Decade of Startup India: Transforming ...

A Decade of Startup India: Transforming ...

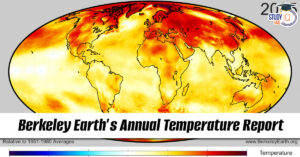

Berkeley Earth Annual Temperature Report...

Berkeley Earth Annual Temperature Report...