Table of Contents

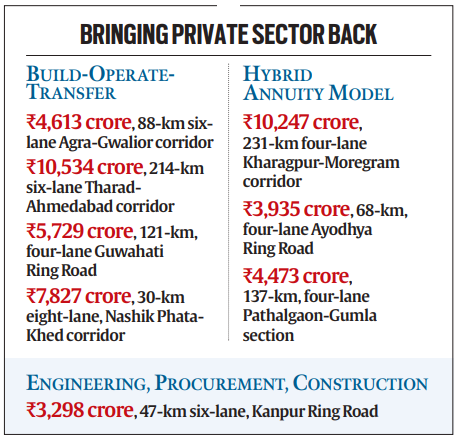

Context: The Union government has approved 8 national high-speed corridor projects at a cost of Rs 50,655 crore.

More in News

- This initiative is expected to generate 4.42 crore man-days of direct and indirect employment.

- 4 of the 8 highways will be executed under the Build-Operate-Transfer (BOT) model.

- The other 4 highways include three Hybrid Annuity Model (HAM) projects and one Engineering, Procurement, and Construction (EPC) project.

About Public-Private Partnership Model (PPP)

- PPPs are collaborations between government and private sector entities for the provision of public assets and services, enabling large-scale projects such as roads, bridges, or hospitals to be completed with private funding.

- In PPPs, private sector entities undertake investments for a specified period.

- PPPs are commonly used for large-scale infrastructure projects like public transportation systems, highways, bridges, hospitals, schools, and parks.

- The government retains full responsibility for providing services, so PPPs do not equate to privatisation.

- There is a clear allocation of risk between the private sector and the public entity.

- Private entities are selected through open competitive bidding and receive performance-linked payments.

- PPPs are particularly beneficial in developing countries where governments face borrowing constraints for essential projects, offering the necessary expertise in planning and execution.

- Advantages:

- Efficiency: Combines private sector efficiency and innovation with public sector accountability and social objectives.

- Expertise: Leverages private sector expertise in areas such as technology and project management.

- Economic Benefits: Can stimulate economic growth by creating jobs and improving infrastructure.

Models of Public-Private Partnership (PPP) in Highway Development

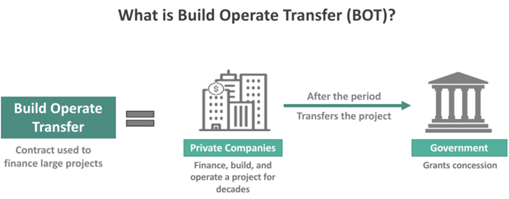

1. Build-Operate-Transfer (BOT)

- Build-Operate-Transfer (BOT) Annuity Model

- The developer builds the highway, operates it for a specified duration, and then transfers it back to the government.

- The government begins payments to the developer after the project starts commercial operations, with payments made every six months.

- Build-Operate-Transfer (BOT) Toll Model

- The developer constructs the road and recovers the investment through toll collection over a period of up to 30 years.

- There is no government payment to the developer; the developer earns revenue solely from tolls.

2. Engineering, Procurement, and Construction (EPC) Model

- The government bears the entire cost of the project.

- The government invites bids for engineering expertise from private players, while it procures raw materials and covers construction costs.

- The model imposes a high financial burden on the government due to full cost responsibility.

3. Hybrid Annuity Model (HAM)

- HAM combines elements of the BOT Annuity and EPC models.

- The government contributes 40% of the project cost over the first five years through annual payments.

- The remaining 60% is paid based on the assets created and the performance of the developer, with the initial 40% paid in five equal instalments and the rest as variable annuity amounts after project completion.

- The developer must raise the remaining 60% of the project cost through equity or loans.

- The National Highways Authority of India (NHAI) is responsible for revenue collection; the developer does not have toll rights.

- HAM provides liquidity to the developer and shares financial risk with the government. The developer bears construction and maintenance risks but only partly bears the financing risk.

- HAM is intended for stalled projects where other models are not suitable.

| What Does Hybrid Annuity Mean? |

| In financial terminology, hybrid annuity means that payment is made in a fixed amount for a considerable period and then in a variable amount in the remaining period. |

Challenges in Public-Private Partnership (PPP) Models

- Policy and Participation:

- Lack of significant success in private participation despite policy measures.

- Infrastructural gaps in almost all sectors, threatening sustained growth.

- Limited success in railways, civil aviation, and social sectors.

- Economic and Financial Constraints:

- Weak regulatory and institutional frameworks.

- Inadequate diligence and appraisal by lenders.

- Financing issues and delays in the issuance of clearances.

- Inappropriate risk allocations and one-size-fits-all approaches to MCAs.

- Aggressive bidding by developers leading to contractual issues.

- Increasing number of non-performing assets (NPAs) held by domestic lenders.

- Infrastructure Leasing & Financial Services (IL&FS) crisis restricting funding options.

- Impact of the global economic slowdown on the demand for goods and services.

- Regulatory and Institutional Issues:

- Inadequate dispute resolution mechanisms.

- Environmental issues delaying project implementation.

- Funding and Investment Challenges: Limited options for domestic lenders and restricted international credit and financing markets.

- Need for innovative instruments and mechanisms to enhance foreign investments.

Way Forward for Revitalising PPPs

- Strengthening Lending Institutions: Enhance the capacities of institutions like India Infrastructure Finance Company, infrastructure debt funds, and the International Finance Corporation (IFC).

- Establish 3P India with a ₹5 billion (US$70 million) corpus to support PPPs.

- Reforming Viability Gap Funding (VGF): Update the VGF scheme to address market challenges and attract more private investment.

- Access to Long-Term Debt: Facilitate access to long-term debt from insurance, pension, and provident fund companies.

- Expand bond markets and use credit enhancement measures through government guarantees.

- Debt Management: Refinance existing debt and restructure non-performing assets (NPAs) of banks.

- Review current restrictions on group exposures of banks to enable more significant investment.

- Enhancing Foreign Investments: Develop innovative instruments and mechanisms to attract foreign capital inflows.

- Offer equity in completed and successful infrastructure projects to long-term investors, including foreign institutional investors.

- Dispute Resolution: Establish the Infrastructure PPP Adjudicatory Tribunal as recommended by the Kelkar Committee for faster dispute resolution.

- Set up independent regulators in sectors lacking them and streamline the roles of existing regulators.

- Model Concession Agreements (MCAs): Review and customise MCAs for each sector to ensure they represent the interests of all stakeholders, including users, project proponents, concessionaires, lenders, and markets.

- Legal Reforms: Amend the Prevention of Corruption Act, 1988, to distinguish genuine errors in decision-making from acts of corruption, preventing witch-hunts against bureaucrats.

Jumping Genes: The Revolutionary Discove...

Jumping Genes: The Revolutionary Discove...

Nitrofurans: Understanding This Class of...

Nitrofurans: Understanding This Class of...

United Nations Alliance of Civilizations...

United Nations Alliance of Civilizations...