Table of Contents

Context: India’s insurance companies have agreed on a simple, comprehensive and customer-friendly model for Bima Vistaar.

About Bima Vistaar

- It is a simple, comprehensive and customer-friendly composite insurance product.

- Initiated by: Insurance Regulatory and Development Authority of India (IRDAI).

- Co-Insurance Model: Each type of risk is co-insured by all insurers dealing with that specific insurance line under an omnibus co-insurance arrangement.

Coverage Areas

- Life insurance (death coverage)

- Personal accident insurance

- Property insurance

- Surgical hospitalisation coverage

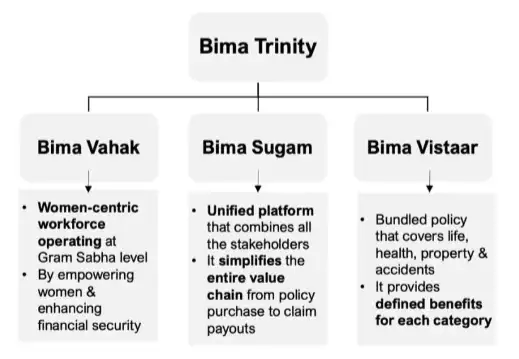

Bima Trinity : A Three-Pronged Approach to Insurance Expansion

This Bima Vistaar initiative aligns with IRDAI’s vision of “Insurance for All by 2047,” striving to make insurance more accessible, affordable, and efficient across India.

Key Features of Bima Vistaar

- Coverage Scope: Offers protection across multiple domains, including life insurance, health insurance, personal accident, and property insurance, all under a single policy.

- Premium Structure:

- Individual Policy: Annual premium of ₹1,500.

- Family Floater Policy: Annual premium of ₹2,420, covering the primary insured and immediate family members.

- Sum Assured:

- Life Insurance: ₹2 lakh.

- Personal Accident: ₹2 lakh.

- Property Insurance: ₹2 lakh.

- Health Insurance (Hospi Cash): Daily benefit of ₹500 for up to 10 days of hospitalization, with a maximum payout of ₹5,000.

- Distribution Model: Emphasizes a women-centric approach through the Bima Vahaak initiative, aiming to empower women as local insurance facilitators to enhance penetration in rural areas.

Mukhyamantri Majhi Ladki Bahin Yojana, O...

Mukhyamantri Majhi Ladki Bahin Yojana, O...

PM MITRA Parks, Objectives, Key Features...

PM MITRA Parks, Objectives, Key Features...

Rashtriya Gokul Mission (RGM), Objective...

Rashtriya Gokul Mission (RGM), Objective...