Context: Finance Minister Nirmala Sitharaman announced plans to negotiate Bilateral Investment Treaties with trade partners to attract more foreign direct investment.

Bilateral Investment Treaties: An Overview

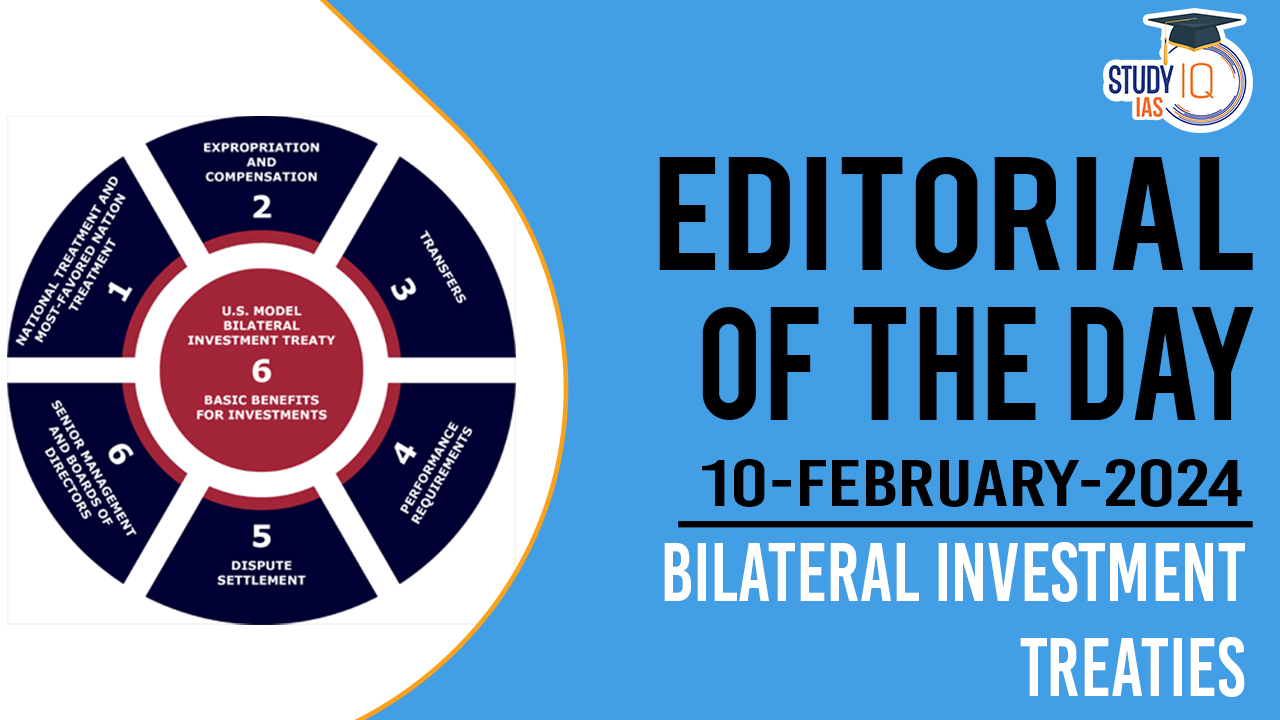

- Definition: BITs are international agreements between two countries to promote and protect mutual investments.

- India’s BIT History: Initiated in the mid-1990s to attract foreign investments with treaty-based protections.

- First BIT: India’s first BIT was signed with the UK in 1994.

India’s BIT Challenges and Reforms:

- Adverse Legal Outcomes: Faced with costly legal disputes, including a significant case against Cairn Energy.

- 2016 BIT Model: Introduced as a response to financial burdens from legal claims, the model was viewed as protectionist.

- Criticism: The 2016 model lacked key international law principles and mandated exhausting local legal remedies before arbitration.

- Termination and Renegotiation: India terminated 68 out of 74 BITs with the intent to renegotiate under the new model.

Impact on Foreign Direct Investment (FDI):

- FDI Decline: Notable decrease in FDI equity inflows recorded in April-September 2023.

- Negotiation Difficulties: India has struggled to renegotiate BITs under the stringent 2016 model, affecting FDI.

Steps Towards Progressive BITs:

- FTA Negotiations: India is negotiating an FTA with the UK, potentially omitting the requirement to exhaust local remedies.

- Parliamentary Recommendations: In 2021, suggestions were made for timely dispute settlements and building local arbitration expertise.

- Ease of Enforcement: India’s low ranking in contract enforcement highlights the need for BIT regime improvements.

We’re now on WhatsApp. Click to Join

Future Outlook:

- $5-Trillion Economy Goal: Progressive BITs are crucial for achieving India’s economic ambitions.

- Government Approach: Current efforts show a positive trend, but a tailored strategy is necessary for sustainable cross-border growth.

- Recommendations Implementation: Critical for improving India’s investment climate and ensuring robust trade and investment stability.

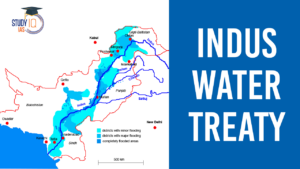

Indus Water Treaty 1960 Suspended by Ind...

Indus Water Treaty 1960 Suspended by Ind...

5 Years of SVAMITVA Scheme and Its Benef...

5 Years of SVAMITVA Scheme and Its Benef...

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...