Table of Contents

Context: A panel formed by the Ministry of Petroleum and Natural Gas has recommended a ban on the use of diesel-powered four-wheel vehicles by 2027 in cities with a population of more than 1 million.

Major Recommendations by the Panel

- Ban on Diesel-Powered Four-Wheelers: The panel recommends a ban on diesel-powered four-wheel vehicles in cities with a population of more than 1 million by 2027 and suggests a transition towards electric and gas-fuelled vehicles.

- Transition of Commercial Vehicles to LNG: The panel suggests that commercial vehicles should transition to liquefied natural gas (LNG) in the short term. LNG is considered a cleaner alternative to diesel and has the potential to reduce greenhouse gas emissions in the logistics market.

- No Addition of Diesel City Buses: The panel recommends that no new diesel city buses be added in urban areas. This measure aims to drive the transition towards clean fuel urban public transport within approximately 10 years. The focus is on promoting alternatives such as electric buses or buses powered by clean fuels like LNG or CNG.

- Mix of Metro Trains and Electric Buses: The panel advises that city transport should be a mix of metro trains and electric buses by 2030 to promote sustainable mobility.

Stats IQ: India’s Automobile Industry

- The Indian automobile industry contributes almost 6.4% of India’s GDP and 35% of manufacturing GDP and is a leading employment provider.

- The Indian automobile sector ranks fifth globally and is expected to rise to third by 2030.

- The Indian passenger car market was valued at US$ 32.70 billion in 2021, and it is expected to reach a value of US$ 54.84 billion by 2027 while registering a CAGR of over 9% between 2022 and 2027.

- India Commercial Vehicles Market is poised to grow at a CAGR of 8.06% by 2028.

- In 2021, petrol vehicles constituted 74% of the Indian passenger vehicle market, followed by diesel vehicles at 18%, CNG vehicles at 7%, and electric vehicles at 0.4%.

Reasons behind the panel’s recommendation for ban on Diesel-Powered Four-Wheel Vehicles

- The proposal is in line with the government’s goal of reducing greenhouse gas emissions, and to produce 40% of its electricity from renewables as part of its 2070 net zero goal.

- Diesel vehicles are known to emit higher levels of pollutants, including oxides of nitrogen (NOx), which contribute to air pollution and have adverse effects on public health.

- The ban on diesel-powered four-wheel vehicles in cities with a population of more than 1 million is aimed at addressing the high pollution levels in urban areas.

- The proposal also recognizes the potential of alternative fuels such as compressed natural gas (CNG) and liquefied natural gas (LNG) in the commercial vehicle segment.

What are the concerns associated with the ban on Diesel Powered Vehicles?

- Practical Implementation: Implementing a complete ban on diesel-powered four-wheelers by 2027 may face practical challenges.

- It involves a significant transition period for both consumers and the automotive industry.

- The infrastructure required to support electric and gas-fueled vehicles needs to be adequately developed, including charging stations and refueling facilities for alternative fuels like LNG.

- Impact on Commercial Vehicles: The proposal’s impact on commercial vehicles, especially trucks and buses, is a major concern.

- Diesel currently serves as the primary fuel for these vehicles due to its higher torque, longer driving range, and higher payload capacity.

- Transitioning commercial vehicles to alternative fuels like LNG or electric may pose challenges in terms of infrastructure availability, cost, and technical feasibility, potentially leading to significant disruptions in the logistics and public transportation sectors.

- Investment in Diesel Technology: Many automakers have invested heavily in upgrading their diesel engine technology to meet the latest emission standards, such as BS-VI.

- A complete ban on diesel vehicles could render these investments obsolete and create financial burdens for the automotive industry.

- Limited Alternatives for Long-Distance Travel: Electric vehicles, while suitable for short-distance travel in urban areas, still face challenges when it comes to long-distance travel and heavy-duty applications.

Current status of India’s Electric Mobility Industry

- There is a total of 13, 92,265 Electric Vehicles (EVs) on Indian roads as on August 2022 (data by Ministry of Road Transport and Highways, India).

- The Economic Survey 2023 predicts that India’s domestic electric vehicle market will see a 49 percent compound annual growth rate (CAGR) between 2022 and 2030, with 10 million annual sales by 2030.

- The Union Government has a target of 30 per cent electric vehicle (EV) penetration in private cars, 70 per cent for commercial vehicles, and 80 per cent for two and three-wheelers by 2030 for the automobile industry.

Challenges of EVs and EV Industry in India

- Insufficient Charging Infrastructure: Challenges in establishing charging stations due to uncertain utilization rates, high operating costs, and concerns about electricity distribution load.

- Consumer Deterrents: Factors hindering consumer adoption of EVs, including concerns about range and safety, resale value uncertainty, limited charging infrastructure, unreliable electricity supply, and price disparity with ICE vehicles.

- Battery Technology Scarcity: Evolving battery technology and its cost implications for EVs, coupled with limited availability of raw materials like rare earth metals.

- Manufacturing Limitations: India’s heavy dependence on imports for crucial EV components, such as rechargeable batteries and equipment, impacting domestic manufacturing capabilities.

- Scrapping Policy Requirement: Environmental challenges associated with high-voltage components in EVs, necessitating a comprehensive policy for proper disposal and recycling.

- Skilled Manpower Shortage: Shortage of trained professionals capable of servicing and repairing EVs due to unique components and systems like batteries and electric motors.

- Data Security Concerns: Protection of sensitive data stored in EVs, requiring robust measures to safeguard user information and vehicle performance data.

Government Steps to Promote Electric Mobility in India

- National Electric Mobility Mission Plan (NEMMP) 2020: Aim to bring about a transformational paradigm shift in the automotive and transportation industry in the country.

- Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME India) Scheme: Launched in 2015 to promote adoption of electric/ hybrid vehicles (xEVs) in the country.

- Battery Swapping Policy: This battery swap policy helps reduce battery costs and promotes affordability. Furthermore, it will boost the sale of electric vehicles.

- GST restructuring: GST on electric vehicles has been reduced from 12% to 5%; GST on chargers/ charging stations for electric vehicles has been reduced from 18% to 5% by GST Council.

- Production Linked Incentive (PLI) scheme for manufacturing of Advanced Chemistry Cell (ACC) in the country in order to bring down prices of battery in the country.

- Auto and Auto component PLI Scheme, hydrogen fuel cell-based vehicles which are Zero Emission Vehicles (ZEVs) are covered under this.

- Model Building Bylaws 2016: Ministry of Housing and Urban Development amended the law to establish charging stations and infrastructure in private and commercial buildings.

- Green license plates: Ministry of Road Transport & Highways (MoRTH) announced that battery operated vehicles will be given green license plates and be exempted from permit requirements.

- Indigenous battery technology: The Indian Space Research Organisation (ISRO) has commercialized indigenously developed lithium-ion battery technology and has selected 14 companies for transfer of technology.

- Electric-Bus Fleet in Cities: The NITI Aayog has taken an initiative to provide a Model Concessionaire Agreement (MCA) document for introducing Electric-Bus Fleet in Cities for Public Transportation on Public-Private Partnership (PPP) mode on Operational Expenditure (per km basis) Model rather than paying upfront capital cost.

SSC CGL Exam 2025 Apply Online Starts Ap...

SSC CGL Exam 2025 Apply Online Starts Ap...

Daily Quiz 19 April 2025

Daily Quiz 19 April 2025

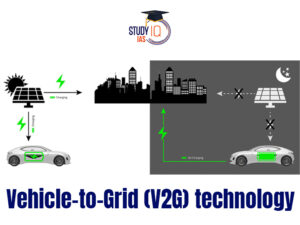

Vehicle-to-Grid (V2G) Technology and its...

Vehicle-to-Grid (V2G) Technology and its...