Table of Contents

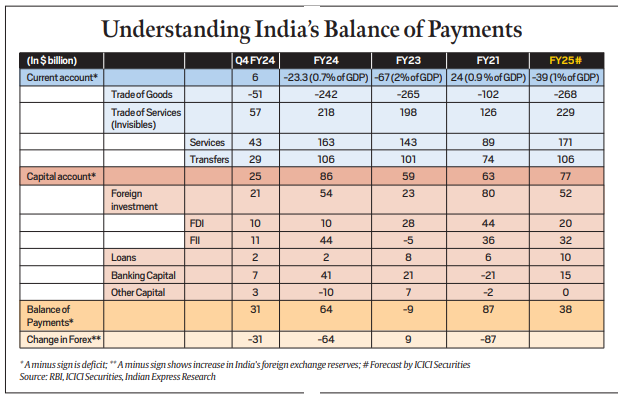

Context: Reserve Bank of India data showed that India registered a current account surplus during the fourth quarter (Jan-Mar) of the FY 2023-24.

Balance of Payment

The Balance of Payments (BoP) is a record of all economic transactions between residents of a country and the rest of the world during a specific period, typically a year. It provides a comprehensive view of the country’s economic relationship with other nations. The balance of payments (BoP) is calculated using the following formula:

BoP = Current Account + Capital Account + Financial Account + Errors and Omissions

- The Balance of Payments monitors money inflows and outflows, with positive entries showing inflows (money received) and negative entries indicating outflows (money spent).

- The BoP is crucial for understanding the demand for a country’s currency relative to foreign currencies, influencing exchange rate movements.

Components of Balance of Payment

The Balance of Payments (BoP) consists of several components that capture different types of economic transactions between residents of a country and the rest of the world. The main components of the balance of payments include:

Current Account

The current account records transactions related to exchanging goods, services, income, and current transfers. It includes:

- Trade of Goods and Services: This account includes the trading of physical goods and services. It shows a balance of trade, with a trade deficit occurring when imports surpass exports.

- Invisibles: This category encompasses services such as banking, insurance, and tourism, as well as transfers like remittances and income from foreign investments.

- Recent Performance: In the last quarter, India experienced a current account surplus, primarily due to a surplus in invisible, despite a trade deficit.

Capital Account

The capital account captures capital transfers and the acquisition or disposal of non-financial assets. It includes:

- Investments: Handles transactions related to investments like Foreign Direct Investment (FDI) and Foreign Institutional Investments (FII).

- Recent Data: The capital account showed a net surplus of $25 billion in the recent quarter.

- Adjustments and Reserves: To maintain balance, any surplus in the BoP leads to adjustments in the foreign exchange reserves, such as the RBI absorbing dollars to prevent excessive appreciation of the rupee, which could hurt export competitiveness.

Financial Account

The financial account tracks transactions related to financial assets and liabilities. It includes:

- Direct Investment: Investments in businesses or properties that result in significant control or influence.

- Portfolio Investment: Investments in financial instruments such as stocks and bonds.

- Other Investment: Transactions involving loans, currency and deposits, trade credits, and other forms of debt.

- Reserve Assets: Changes in a country’s reserve holdings, typically consisting of foreign currencies and gold.

Errors and Omissions

This component accounts for any unrecorded or inaccurately recorded transactions that may result in discrepancies in the balance of payments.

| Important Facts |

|

Difference Between Balance of Payment and Balance of Trade

Here are the key differences between a Balance of Payment and a Balance of Trade:

| Balance of Payment (BoP) | Balance of Trade (BoT) | |

| Definition | A comprehensive record of all economic transactions between residents of a country and the rest of the world over a specific period | Difference between the value of a country’s exports and imports of goods (merchandise trade) over a specific period |

| Components | The current account, capital account, financial account, errors and omissions | Trade in goods (merchandise trade) |

| Coverage | Trade in goods, services, income flows, and transfers (current and capital) | Trade in physical goods (raw materials, manufactured goods, commodities) |

| Focus | A comprehensive view of a country’s economic transactions with the rest of the world | Focuses solely on the trade of goods |

| Inclusion of Services, Income Flows, and Transfers | Yes | No |

Disequilibrium of Balance of Payments

Disequilibrium in the balance of payments refers to a situation where there is an imbalance or disparity between the inflows and outflows of economic transactions in a country’s balance of payments. It indicates that the country’s international payments are not in equilibrium, meaning that it is either experiencing a surplus or a deficit. Disequilibrium in the balance of payments can occur in two forms:

Surplus

A surplus in the balance of payments occurs when the inflows of foreign currency, such as from exports, foreign investments, or borrowing, exceed the outflows, such as imports, capital outflows, or repayment of foreign loans. A surplus implies that the country is a net creditor to the rest of the world.

Deficit

A deficit in the balance of payments occurs when the outflows of foreign currency exceed the inflows. This typically happens when a country imports more goods and services than it exports, or when it experiences capital outflows or debt repayments that outweigh capital inflows. A deficit implies that the country is a net debtor to the rest of the world.

Importance of Balance of Payment

The balance of payments (BoP) holds significant importance due to the following reasons:

Economic Indicator

The BoP serves as a crucial economic indicator that reflects a country’s economic relationships with the rest of the world. It provides valuable information on trade flows, financial transactions, and overall economic health.

Policy Formulation

The BoP helps policymakers formulate and evaluate economic policies. It provides insights into a country’s competitiveness, external trade performance, capital flows, and monetary stability. Policymakers can use this information to design appropriate policies to address imbalances and promote economic growth.

Exchange Rate Management

The BoP is closely linked to exchange rates. By monitoring the BoP, central banks can assess the supply and demand of foreign currency, determine the need for currency interventions, and manage exchange rate stability.

External Debt Management

The BoP is essential in managing external debt. It helps countries monitor their capacity to service foreign debt obligations and assess the sustainability of borrowing levels. A healthy BoP position supports prudent debt management and reduces the risk of external financial vulnerabilities.

Investment Decisions

Investors and financial institutions analyze the BoP to assess the attractiveness of a country for investment. A favorable BoP position, indicating stability and positive economic prospects, can attract foreign investment and contribute to economic development.

Policy Coordination

The BoP facilitates coordination among countries, particularly in the context of international economic organizations. It enables policymakers to identify areas of cooperation, address global imbalances, and promote stability in the international financial system.

Balance of Payment Crisis

A balance of payment (BoP) crisis occurs when a country faces severe imbalances in its external accounts, leading to difficulties in meeting its international payment obligations. It typically involves a rapid depletion of foreign exchange reserves, currency depreciation, difficulties in accessing external financing, and potential disruptions in trade and capital flows. Here are a few examples of BoP crises:

Asian Financial Crisis (1997-1998)

Several Southeast Asian countries, including Thailand, Indonesia, South Korea, and Malaysia, experienced a severe BoP crisis. It was triggered by a combination of factors such as excessive borrowing, currency speculation, weak financial systems, and sudden capital outflows. These countries faced currency depreciations, sharp declines in foreign exchange reserves, and economic contractions.

Argentine Economic Crisis (2001-2002)

Argentina went through a major BoP crisis characterized by a deep recession, a default on its sovereign debt, and a sharp depreciation of its currency, the peso. The crisis was caused by a combination of factors, including unsustainable fiscal policies, a fixed exchange rate regime, and external shocks. Argentina faced difficulties in servicing its debt and experienced a severe contraction in economic activity.

Greek Debt Crisis (2010-2015)

Greece faced a BoP crisis as it struggled with high levels of public debt and fiscal imbalances. The crisis was triggered by concerns about the sustainability of Greek debt, leading to a loss of market confidence and difficulties in borrowing. Greece required multiple bailout packages from international institutions, experienced significant economic contraction, and underwent a debt restructuring.

Turkish Currency Crisis (2018-2019)

Turkey faced a BoP crisis characterized by a rapid depreciation of its currency, the lira, and rising inflation. The crisis was influenced by factors such as high external debt, political tensions, and concerns about the independence of the central bank. Turkey faced challenges in managing its external obligations and maintaining stability in financial markets.

These examples illustrate how BoP crises can have profound economic and financial consequences, including currency devaluations, capital flight, recessions, and difficulties in meeting international payment obligations. They highlight the importance of sound economic policies, prudent debt management, and maintaining macroeconomic stability to avoid or mitigate BoP crises.

Balance of Payment UPSC

The topic of Balance of Payment is significant for UPSC (Union Public Service Commission) as it is included in the economy section of the UPSC Syllabus. Understanding the Balance of Payment is essential for aspirants preparing for the UPSC examination as it helps in comprehending a country’s economic relationships with the rest of the world, analyzing trade competitiveness, assessing financial stability, and evaluating the overall health of international transactions. Aspirants can enhance their knowledge through UPSC Online Coaching and practice with UPSC Mock Test to gain proficiency in this topic and excel in the examination.

Foreign Contribution Regulation Act (FCR...

Foreign Contribution Regulation Act (FCR...

World Economic Forum’s Future of Jobs ...

World Economic Forum’s Future of Jobs ...

Rising Household Debt, Trends, Causes an...

Rising Household Debt, Trends, Causes an...