Table of Contents

The Finance Commission, a constitutionally mandated body established under Article 280 of the Constitution, plays a pivotal role in shaping financial relations between the central and state governments in India.16th Finance Commission was constituted on December 31, 2023, headed by Shri Arvind Panagariya, former Vice-Chairman of NITI Aayog. Recently, the government has taken a significant step by appointing 4-key members to shape the Sixteenth Finance Commission (SFC). Out of them, three are designated as full-time members and one is part-time member. In this article, you will get all the important information about the 16th Finance Commission in detail.

Key Information about 16th Finance Commission

| Key Information | Details |

| Background | The Finance Commission, established under Article 280, shapes financial relations between the central and state governments. Originated in 1951 and the Fifteenth Finance Commission was formed in November 2017 for making recommendations for a five-year period of 2020-21 to 2024-25. |

| Constitution of 16th Finance Commission | The government establishes the 16th Finance Commission and appoints Dr. Arvind Panagariya as Chairman. The Sixteenth Finance Commission has been requested to make its report available by the 31st day of October 2025 covering five years commencing on the 1st day of April 2026. |

| Terms of Reference |

|

| Chairman | Dr. Arvind Panagariya, former Vice-Chairman of NITI Aayog and Professor at Columbia University. |

| Deadline for Report | October 31, 2025. |

We’re now on WhatsApp. Click to Join

Constitution of Sixteenth Finance Commission

Under Article 280(1) of the Constitution, the Government of India has instituted the 16th Finance Commission of India, designating Dr. Arvind Panagariya, former Vice-Chairman of NITI Aayog and Professor at Columbia University, as its Chairman.

The Commission’s specific terms of reference encompass crucial aspects such as the equitable distribution of tax proceeds between the Union and States, guiding principles for grants-in-aid to States, and initiatives to enhance State funds for local bodies, including Panchayats and Municipalities.

Additionally, the 16th Finance Commission of India has been entrusted with the critical task of reviewing the current arrangements for disaster management financing as outlined in the Disaster Management Act of 2005. The Commission is expected to provide recommendations for improvements in this domain.

The Government has set a deadline for the 16th Finance Commission to present its comprehensive report by October 31, 2025, reflecting the commitment to timely and informed decision-making in matters of fiscal policy and disaster management financing.

Appointed Members for Sixteenth Finance Commission

| S.No. | Members Name | Term |

| 1. | Shri. Ajay Narayan Jha, former member, 15th Finance Commission and former Secretary, Expenditure | Full time Member |

| 2. | Smt. Annie George Mathew, former Special Secretary, Expenditure | Full time Member |

| 3. | Dr. Niranjan Rajadhyaksha, Executive Director, Artha Global | Full time Member |

| 4. | Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India | Part time Member |

Terms of Reference for 16th Finance Commission

The detailed terms of reference for the Sixteenth Finance Commission, outlined in the notification, include the following key matters:

- Distribution of the net proceeds of taxes between the Union and the States under Chapter I, Part XII of the Constitution, along with the allocation of shares among the States.

- Determination of principles guiding grants-in-aid from the Consolidated Fund of India to the States, as well as the sums to be granted to the States for purposes specified in Article 275 of the Constitution, excluding those mentioned in the provisos to clause (1) of that article.

- Identification of measures required to enhance the Consolidated Fund of a State, supporting the resources of Panchayats and Municipalities in the State based on recommendations made by the State’s Finance Commission.

The Sixteenth Finance Commission is also empowered to review existing arrangements for financing Disaster Management initiatives, particularly with regard to funds established under the Disaster Management Act of 2005 (53 of 2005), and provide suitable recommendations.

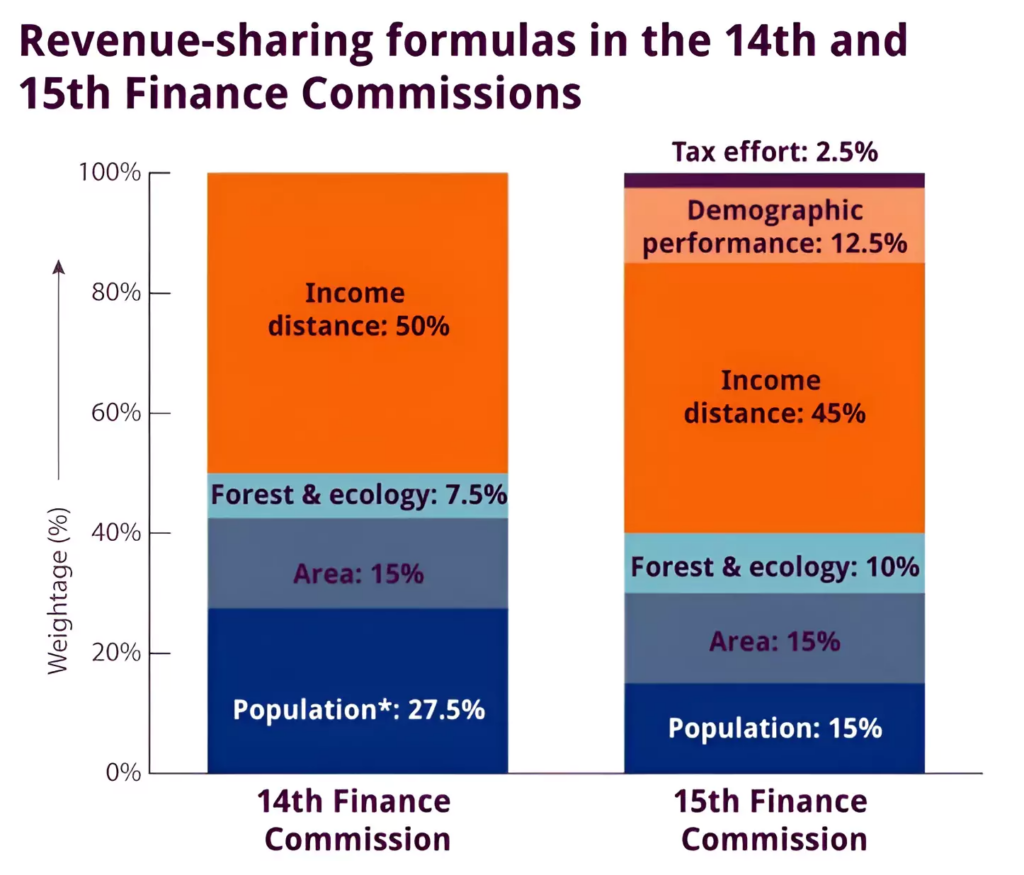

15th Finance Commission of India

The 15th Finance Commission of India was established on November 27, 2017. The commission was established by President Ram Nath Kovind. The commission’s purpose is to provide recommendations for fiscal matters and tax devolution for five fiscal years, beginning April 1, 2020. The 15th Finance Commission, chaired by Mr. N. K. Singh, was tasked with submitting two reports. The initial report, containing recommendations for the financial year 2020-21, was presented to Parliament in February 2020. Subsequently, the final report, encompassing recommendations for the period of 2021-26, was laid before Parliament on February 1, 2021.

The commission’s recommendations include a path for the fiscal deficit that would reduce the centre’s total liabilities from 62.9% of GDP in 2020-21 to 56.6% in 2025-26. The commission also recommends that states’ liabilities be reduced from 33.1% of GDP in 2020-21 to 32.5% by 2025-26.

Challenges of 16th Finance Commission

The 16th Finance Commission (FC) faces several challenges, including:

Cess and Surcharges

- The effective share of states in the Centre’s Gross Tax Revenues decreased from 35% to 31%.

- GST council decisions impact revenue projections and FC calculations.

Political Challenges

- GST has increased fiscal equality but also led to Rs 30,000 crore GST evasion using stolen IDs in 16 states.

Implementation Challenges

- Balancing interests of Union government, state governments, local bodies, and civil society groups.

- Considering changing political and economic scenarios nationally and globally.

Fiscal Consolidation by States

- FC tasked with making recommendations for sound finance.

Difficult Fiscal Environment

- Challenges in navigating the tense fiscal relationships between the Union and certain states in the federal structure of India.

| Previous Year Question |

Q. With reference to the Finance Commission of India, which of the following statements is correct? (2011)

Answer: (d) |

What is Finance Commission?

The Finance Commission is a constitutional body in India that recommends how to distribute financial resources between the central and state governments. The President of India establishes the commission every five years under Article 280 of the Constitution.

About the Finance Commission

- Body: It is a statuary, independent, non-political body.

- Composition: It consists of a chairman and four other members.

- First Constituted: The First Finance Commission was constituted on April 6, 1952

- Constitutional Mandate: Article 280(1) of the Constitution mandates the establishment of the Finance Commission every fifth year or sooner.

- Appointed by: The President Of India

- Qualification: As prescribed by the Parliament.

- Chairman: Must have experience in public affairs.

- Other Members (4):

- High Court judge or qualified to become one.

- Specialised knowledge of government finance and accounts.

- Experience in financial matters and administration.

- Special knowledge of economics.

- Purpose: To ensure fair and equitable distribution of tax revenue between the central government (Union) and individual states.

- Functions: Article 280 (3) states that it shall be the duty of the Commission to make recommendations to the President as to:

- Tax Distribution: Recommend fair division of shared tax revenue between Union and states, and among states themselves (every 5 years).

- Grants-in-Aid: Establish principles for the Union government to provide financial assistance to states.

- Local Government Support: Advise on strengthening state finances to benefit local bodies like panchayats and municipalities.

- Financial Consultation: Offer expert advice on any financial matters referred by the President, promoting sound fiscal policies.

- Submission: Report -> President -> Parliament

- Quasi-Judicial Powers: Hold powers similar to a civil court(based on Code of Civil Procedure 1908) for summoning witnesses and accessing documents.

Main Responsibilities of Finance Commission

- Defining the financial relationship between the central and state governments

- Recommending how to distribute tax revenues between the Union and the states

- Recommending how to distribute tax revenues among the states

- Recommending monitorable performance criteria for important national programs

- Examining the possibility of establishing a permanent funding source for India’s defense needs

16th Finance Commission UPSC

The 16th Finance Commission, established under Article 280, is pivotal in shaping financial relations between India’s central and state governments. Led by Dr. Arvind Panagariya, it addresses challenges like decreasing state share in tax revenues, GST-related fiscal equality and evasion issues, and the delicate balance of interests among stakeholders. Mandated to enhance state funds and review disaster management financing, the Commission faces complex fiscal dynamics. Set to report by October 31, 2025, it builds on the legacy of its predecessor, the 15th Finance Commission, which recommended fiscal deficit reduction paths for both the center and states.

Waqf Act (Amendment) 2025: Key Highlight...

Waqf Act (Amendment) 2025: Key Highlight...

List of Military Exercises of India 2024...

List of Military Exercises of India 2024...

Places in News for UPSC 2025 for Prelims...

Places in News for UPSC 2025 for Prelims...